Indonesia and Thailand - two exotic corners of Southeast Asia, which have long attracted the attention not only of tourists, but also of investors. These countries offer unique opportunities for real estate investment, but where are the conditions more favorable?

Analysis of the real estate market in Indonesia

When it comes to Indonesia, the first introduction is Bali. This island has long been a mecca for investorsand it's no wonder. Bali offers not only stunning beaches and rich culture, but also a growing real estate market. Many foreigners are dreaming buy Bali real estateTo enjoy the tropical climate and generate rental income.

The average cost per square meter in Bali is approx. €2,000 - €3,500Depending on the location and type of accommodation. In popular areas such as Seminyak and Ubud, prices may be higher due to high demand and limited supply.

Now let's take a look at Jakarta, the capital of Indonesia. This metropolis is rapidly developing and becoming more and more attractive for investors. Jakarta offers a variety of opportunities, from luxury apartments to commercial space. The growth prospects here are impressiveespecially with plans for infrastructure development such as new interchanges and improved public transportation. The cost per square meter in Jakarta ranges from €1,500 to €3,000.

Not to forget Lombok - this is another region that deserves attention. The real estate market here is just starting to pick up, which opens up excellent opportunities for early investors. Lombok could be the next Bali, and those who invest now could benefit significantly in the future. Prices here are more affordable, ranging from €800 per square meterThis makes Lombok attractive to those looking for a budget investment.

Prospects and trends

Indonesia is actively developing its infrastructure, especially in tourist areas. In the coming years, many projects are planned that may significantly affect the real estate market. Tourist traffic continues to growThis also contributes to an increase in demand for rental housing and, consequently, to price growth.

Indonesia offers certain opportunities for foreign investors, but there are also restrictions. Foreigners can purchase real estate on lease for up to 80 years, but it is not possible to purchase land directly. This should be taken into account when planning investments. Taxation in Indonesia is also important to consider: the tax on the purchase of real estate is 5% of the costand the annual property tax levy is about 0,5%.

Now let's move on to Thailand and take a look at what opportunities it offers for investors.

Analysis of the real estate market in Thailand

When it comes to Thailand, the first thing that comes to mind is... Bangkok. This is the city that never sleeps and it offers tremendous opportunities for investors. Here you can buy real estate in Bangkok for a variety of purposes, from residential to rental. Bangkok is not only the cultural and economic center of the country, but also one of the most dynamic real estate markets in the region. The average cost per square meter here is €2,800 - €6,500depending on the neighborhood and class of housing.

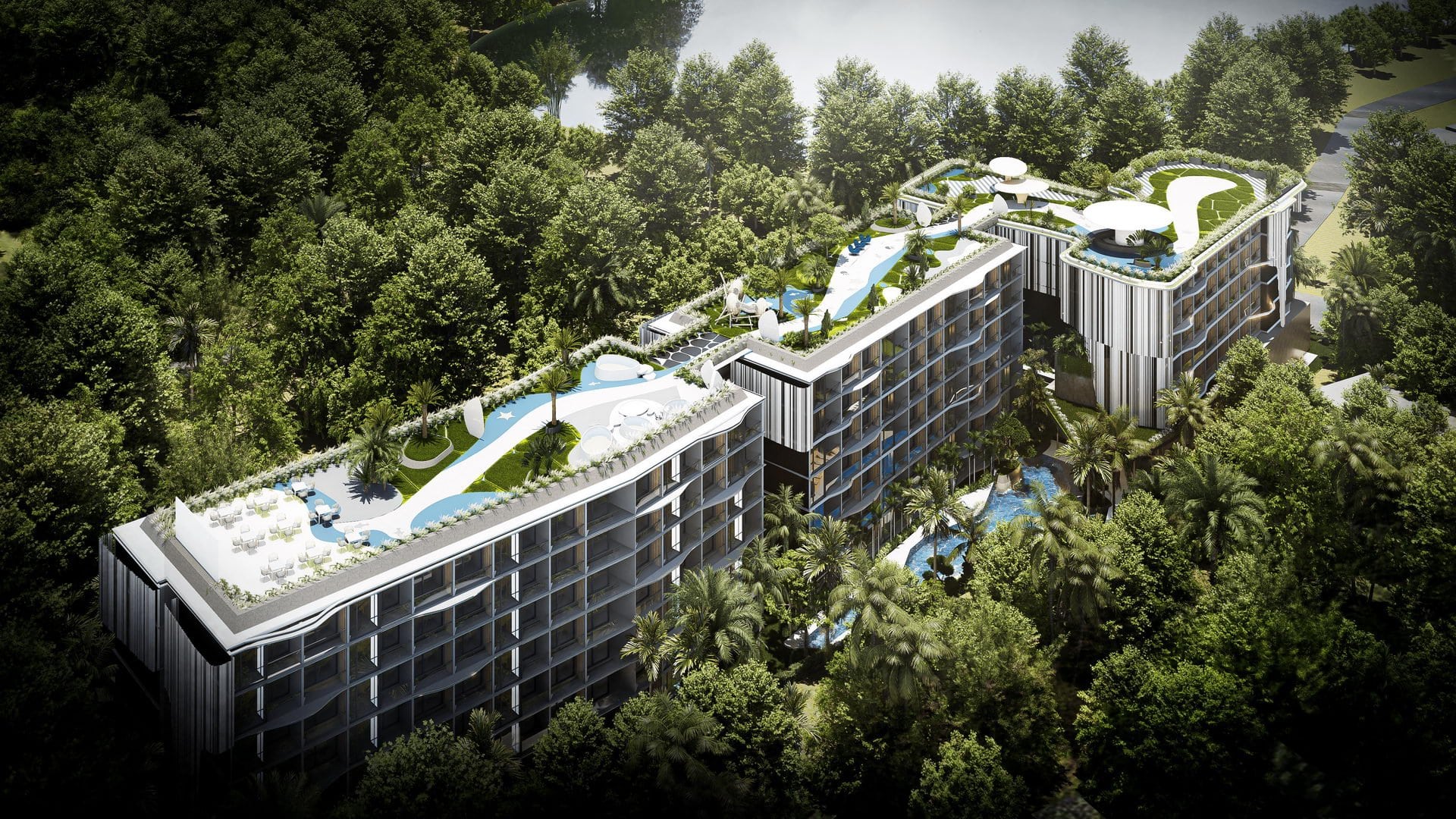

Let's go to PhuketPhuket is famous for its beaches and resorts. Phuket real estate is in demand among those looking to invest in resort properties. Phuket offers a wide range of villas and apartments that can be rented out to tourists, making it attractive to investors looking for rental yields in Thailand. Prices in Phuket range from €2,300 to €5,500 per square meter.

Pattaya - is another destination worth considering. It is a popular resort that attracts both tourists and investors. In Pattaya you can find real estate for every taste and budget. Investments in real estate in ThailandEspecially in places like Pattaya, can bring a good income due to the large flow of tourists. Here you can find more affordable options, from €1,400 per square meter.

Accessibility for foreign investors

Thailand offers foreigners the opportunity to purchase apartments, but with restrictions on land purchases. Legislation allows foreigners to own up to 49% apartments in one residential complex. This is important to consider when planning your investment. Taxation of real estate in Thailand includes purchase tax, which is as follows 1% from cost, and an annual property tax that varies depending on the value of the property.

Growth Prospects

The tourist flow to Thailand continues to grow, which has a positive impact on the real estate market. Planned infrastructure projects such as new transportation interchanges and airport improvements are also contributing to the country's increasing attractiveness to investors. The outlook for the real estate market in Thailand looks promisingespecially in resort areas.

With all these factors in mind, Thailand remains one of the top destinations for real estate investment in Southeast Asia. For a successful investment, it is important to consider not only current prices, but also long-term growth prospects and legal restrictions.

Comparison of Key Investment Factors in Indonesia and Thailand

When choosing between investing in Indonesian real estate and Thailand, it is important to consider the various factors that may affect your investment strategy. These countries offer unique opportunities but differ in terms of cost, returns, legal aspects and risks. Let's take a look at the main parameters in the table below.

| Factor | Indonesia | Thailand |

|---|---|---|

| Price per 1 sq.m. on average | Lombok: €800; Bali: €2,000 - €3,500 | Bangkok: €2,800 - €6,500; Phuket: €2,300 - €5,500 |

| Formalization | Rent for up to 80 years for foreigners | Ownership of up to 49% apartments in one complex |

| Tax on the purchase of real estate | 5% at cost | 1% at cost |

| Real estate ownership tax, per year | 0,5% property value | Varies depending on cost |

| Payback | 15-17 years old | 10-12 years old |

| Rent per day, average | Bali: €60 - €120 | Phuket: €80 - €150 |

| Profit per year, on average | About 6-7% | Before 8% |

| Annual growth of tourists | 5-7% | 6-8% |

| Real estate price growth per year | 3-5% | 4-6% |

The choice between Indonesia and Thailand depends on your investment goals and preferences. Indonesia offers more affordable prices and growth potential, while Thailand provides stability and high rental yields. Consider all aspects including cost, profitability, taxation and risk to make an informed decision. It is important to carefully analyze all factors and consult with experts, if necessary, to maximize your investment opportunities.

Nuances when buying a home in Indonesia and Thailand

When starting to buy real estate in Indonesia or Thailand, it is important to carefully study all the nuances and peculiarities related to legislation, taxation and the process of registration. These aspects can significantly affect your decision and further investment plans.

Indonesia

Legal aspects and formalization

In Indonesia, foreigners cannot directly own land, but can purchase real estate on a lease for up to a 80 years. This is done through the Hak Pakai system, which allows foreigners to use the land and buildings on it. It is important to note that a local lawyer will need to be hired to properly prepare all documents and avoid potential legal complications.

Taxation

When buying real estate in Indonesia, a tax of 5% of the cost. The annual tax on real estate ownership is approx. 0,5%. These taxes need to be considered when budgeting for the purchase and maintenance of real estate.

Additional costs

In addition to taxes, the purchase should take into account the costs of paperwork, legal and real estate agency services, which can amount up to €1,000 - €2,000 depending on the complexity of the deal.

Thailand

Legal aspects and formalization

In Thailand, foreigners can purchase apartments, but with a restriction on land purchases. Foreigners are allowed to own up to 49% apartments in one residential complex. It is advisable to use a local lawyer to complete the transaction to ensure that all documents are in compliance with Thai law.

Taxation

The tax on the purchase of real estate is 1% from costand the annual property tax varies depending on the value of the property and can range from 0.01% to 0.1%. This makes Thailand more attractive to investors looking for low tax rates.

Additional costs

When buying real estate in Thailand, you should take into account the costs of paperwork, which can amount to €500 - €1,500. It is also important to budget for translation and notarization costs.

When buying real estate in Indonesia and Thailand, it is important to thoroughly research all legal and tax aspects to avoid unexpected costs and legal complications. It is recommended to contact professionalsIt is important to be aware of all the nuances and be prepared for possible changes in legislation that may affect your investment strategy. Regardless of the country you choose, it is important to consider all the nuances and be prepared for possible changes in legislation that may affect your investment strategy.

Similarities and peculiarities of the real estate market in Indonesia and Thailand

Despite their geographical proximity, the real estate markets of Indonesia and Thailand have both similarities and unique features. Understanding these nuances will help investors make more informed choices and maximize the benefits of their investments.

Similarities

- Tourist attraction: Both countries are renowned for their scenic landscapes and rich cultural heritage, making them popular tourist destinations. This creates a high demand for rental accommodation, especially in regions such as Bali and Phuket. Annual growth of tourists in both countries is approximately 5-8%which contributes to a stable demand for short-term rentals.

- Growing market: Indonesia and Thailand have shown steady growth in real estate prices, with an average of 3-6% per year. This is due to infrastructure development, improved transportation accessibility and increased tourist numbers, making both markets attractive for long-term investment.

- Interest of foreign investors: Both countries actively attract foreign investors by offering various real estate investment opportunities. Despite legal restrictions related to the purchase of land, foreigners can purchase apartments and villas, making these markets open to international investment.

Features

- Legal restrictions: In Indonesia, foreigners can only purchase real estate on a leasehold basis for up to 80 yearsThis requires careful paperwork and local lawyers. In Thailand, foreigners are allowed to own up to 49% apartments in one residential complexwhich simplifies the process of investing in residential real estate.

- Taxation: Differences in tax policies also play an important role. In Indonesia, the purchase tax is 5%whereas in Thailand it's only 1%. Annual ownership taxes also vary: in Indonesia it is approx. 0,5%and in Thailand, from 0.01% to 0.1%. These differences can have a significant impact on the overall cost of maintaining a property.

- Pricing policy: Real estate prices in Indonesia, especially in Lombok, can be more affordable, ranging from €800 per square meterWhile in Thailand, in the popular areas of Bangkok and Phuket, prices can be as high as $200,000, in the popular areas of Bangkok and Phuket. €6,500 per square meter. This makes Indonesia more attractive to investors on a tight budget, while Thailand offers more stable properties with high yield potential.

Outlook for growth and development of resort real estate in Indonesia and Thailand

Indonesia and Thailand continue to be a focus for investors due to their growth prospects and resort real estate development. These countries offer not only picturesque beaches and unique cultures, but also significant potential for asset appreciation and rental income.

Indonesia

Infrastructure development: Indonesia is actively investing in infrastructure development, which has a positive impact on the real estate market. In the coming years, major projects are planned to improve transport accessibility and modernize airports, especially in Bali and Lombok. These changes could significantly increase the attractiveness of the regions for tourists and investors.

Bali and LombokBali remains a key destination for investment in resort real estate. The average cost per square meter here is €2,000 - €3,500But with the increase in tourist traffic, prices are expected to continue to rise by 3-5% per year. Lombok, on the other hand, offers more affordable prices from . €800 per square meter and has every chance to become a new center of attraction for investors due to its natural beauty and active development.

Tourist flow: Indonesia's annual tourist growth rate is projected to be approx. 5-7%This stimulates demand for rental housing and creates conditions for stable growth of real estate prices.

Thailand

Infrastructure projects: Thailand is also actively developing its infrastructure, which is contributing to the growth of the real estate market. There are plans to expand transportation networks and modernize airports in key tourist areas such as Phuket and Pattaya, which will increase their attractiveness to tourists and investors.

Phuket and Pattaya: Phuket is known for its beaches and luxury resorts, making it one of the most sought-after investment destinations. The cost per square meter here ranges from €2,300 to €5,500and prices are expected to rise by 4-6% per year. Pattaya, with more affordable prices from . €1,400 per square meteroffers excellent opportunities for those looking for properties with high yield potential.

Tourist flow: Thailand continues to attract a significant number of tourists, with an expected annual growth rate of 6-8%. This creates a steady demand for rentals and contributes to rising real estate prices.

Short and long-term rental yields in Indonesia and Thailand

Investing in real estate for rental purposes is one of the most popular ways to generate income in Indonesia and Thailand. Both markets offer unique opportunities to profit from both short-term and long-term rentals. Let's take a look at what prospects are available to investors in these countries.

Indonesia

Short-term rentals

Indonesia, due to its tourist appeal, provides excellent opportunities for short term rentals, especially in Bali. The average cost of renting a villa or apartment for a day varies from €60 to €120Depending on the location and comfort level. The high season, which lasts from June to September, as well as the New Year holidays, can increase the yield to €150 per day.

Long-term lease

Long-term rentals in Indonesia are also in demand, especially among expats and long-term tourists. The average income from a long-term rental can be approx. €500 - €1,000 per month for a standard apartment in Bali. These rentals provide a stable income and reduce property management costs.

Profit and payback

Expected rental yields for real estate in Bali are as follows 6-7% p.a.which makes it attractive for investors. The return on investment in real estate can be as high as 15-17 years oldDepending on the level of initial investment and management strategy.

Thailand

Short-term rentals

Thailand, especially such tourist centers as Phuket and Pattaya, offers high yields from short-term rentals. The average rental price per day here is €80 - €150Depending on the season and type of property. The high tourist flow ensures stable demand and the possibility of a significant increase in income during peak periods.

Long-term lease

Long-term rentals in Thailand are also a popular option, especially among foreigners working in the country. The average monthly rent for an apartment in Bangkok or Phuket is as follows €600 - €1,200. Long-term leases provide lower risk and stable monthly income.

Profit and payback

Rental yields in Thailand can be as high as 8% p.a.This makes the country particularly attractive for investors focused on receiving a regular income. The payback period for real estate investments can be as follows 10-12 years oldwhich is an excellent indicator for the investment market.

Economy and life in Indonesia and Thailand

Indonesia and Thailand, the two pearls of Southeast Asia, attract not only tourists but also investors from around the world. Understanding the economic environment and quality of life in these countries will help you make an informed decision about investing in real estate and living in the region.

Indonesia

economic environment

Indonesia is the largest economy in Southeast Asia, showing steady growth. The main drivers of the economy include agriculture, mining and tourism. In recent years, the government has been actively investing in infrastructure development, which creates a favorable environment for business and investment. The country's GDP is expected to continue to grow, supporting demand for real estate and improving the economic outlook.

Quality of life

Indonesia offers a diverse lifestyle, from the vibrant city life in Jakarta to the laid-back atmosphere in Bali. The cost of living is relatively low: renting an apartment in the center of Jakarta costs approx. €400 - €700 per monthand in Bali it's about €300 - €600. Products and services are also available at reasonable prices, making life in Indonesia comfortable and affordable for expats and tourists.

Social sphere and culture

Indonesia is known for its cultural diversity and hospitality. The locals are friendly and helpful, creating a favorable environment in which to live and work. Education and health care continue to grow, offering quality services at affordable prices.

Thailand

economic environment

Thailand is one of the fastest growing economies in the region, with a focus on tourism, manufacturing and agriculture. The government actively supports investment in infrastructure and innovation, which contributes to economic growth and strengthens the country's position on the global stage. The stable economy provides a steady demand for housing and creates a favorable environment for investors.

Quality of life

Thailand offers a high quality of life at an affordable price. Renting an apartment in Bangkok costs about €500 - €1,000 per monthand in Phuket. €400 - €800. The country is famous for its markets, street food and rich cultural heritage, making it an attractive place to live and vacation.

Social sphere and culture

Thailand is known for its culture of hospitality and friendly attitude towards foreigners. The country offers a wide range of international schools and medical facilities, making it attractive to families and expats. The local culture, with its festivals and traditions, adds a unique flavor to everyday life.

Education and medicine in Indonesia and Thailand

When choosing a country for real estate investment or relocation, education and medicine play a key role. Indonesia and Thailand offer different opportunities in these areas, and understanding them will help you make an informed decision.

Indonesia

Education

Indonesia is actively developing its educational system, offering both public and private educational institutions. Major cities such as Jakarta and Surabaya are home to international schools that provide instruction in English through international programs. Tuition fees at international schools can range from €5,000 to €15,000 per year depending on the level and reputation of the institution. Higher education is also represented by a number of universities that cooperate with foreign partners and offer exchange programs.

Medicine

Medicine in Indonesia is developing rapidly and modern medical centers and clinics are available in major cities. Jakarta and Bali offer a wide range of medical services, including specialized and aesthetic procedures. The cost of medical services is relatively low compared to Western countries, making Indonesia attractive for medical tourism. For example, a consultation with a specialist can cost approx. €30 - €50.

Thailand

Education

Thailand offers a variety of educational opportunities including international and bilingual schools in Bangkok, Phuket and Chiang Mai. These schools follow international standards and offer programs such as IB and Cambridge. Tuition fees at international schools range from €7,000 to €20,000 per year. Higher education is represented by both local universities and branches of foreign universities, which offers a wide range of opportunities for students.

Medicine

Thailand is known for its high level of medical services and developed healthcare infrastructure. Bangkok and other major cities offer a wide range of hospitals and clinics certified according to international standards. Thailand is also a popular destination for medical tourism due to its affordable prices and high quality of services. For example, a complete medical checkup can cost as much as $30,000. €300 - €500which is much cheaper than in Europe or the USA.

Roads and transportation in Indonesia and Thailand

An efficient transportation system and road infrastructure play a key role in economic development and quality of life in any country. Indonesia and Thailand are actively investing in improving their transportation networks to ensure comfortable travel for locals and tourists.

Indonesia

- Road infrastructure: Indonesia, as the largest archipelago in the world, faces unique challenges in transportation infrastructure. In recent years, the government has been actively developing the road network, especially on islands such as Java, Sumatra and Bali. Major highways link major cities, improving accessibility and reducing travel times. However, roads may be less developed in rural areas.

- Public transportation: In major cities such as Jakarta, public transportation is provided by buses, commuter trains, and the newly built subway system. The subway fare is approx. €0,30 - €0,50 per trip. Cabs and scooter rentals are popular in Bali and other tourist islands, making it easy to get around.

- Air service: Indonesia is actively developing its aviation infrastructure, modernizing existing airports and building new ones. This is especially important for connectivity between islands. Airfares for domestic flights are available from €30 one way, making traveling around the country affordable and convenient.

Thailand

- Road infrastructure: Thailand has a well-developed road network, especially in the central part of the country and near major cities. Highways and expressways connect Bangkok with other regions, which makes traveling convenient and fast. This makes traveling by car comfortable and safe.

- Public transportation: Bangkok offers a variety of public transportation options, including subway (MRT), overground metro (BTS) and buses. The BTS fare is approx. €0,50 - €1,50The cost of a taxi and motorbike rental is around $500, depending on the distance. In tourist areas such as Phuket and Pattaya, cabs and motorcycle rentals are popular, making it easy for tourists to explore local attractions.

- Air service: Thailand is an important aviation hub in Southeast Asia, with international airports in Bangkok, Phuket and Chiang Mai. Domestic flights are available from €20This makes traveling around the country quick and convenient. A well-developed air service network increases the tourist flow and makes the country attractive to international travelers.

Legal and tax peculiarities when buying real estate in Indonesia and Thailand

Understanding the legal and tax aspects of buying real estate in Indonesia and Thailand is key to a successful investment. These countries offer unique opportunities for investors, but also have their own requirements and restrictions. Let's review the main points in the table below.

| Aspect | Indonesia | Thailand |

|---|---|---|

| Ownership | Foreigners can only purchase real estate for rent for a period of up to 80 years through the Hak Pakai system. Direct purchase of land is not possible. | Foreigners can own up to 49% apartments in the same apartment complex, but cannot directly own the land. |

| Clearance process | Formalization of the transaction requires a local lawyer to prepare the documents and register them with the land registry. | The transaction is formalized through a lawyer and a notary, registration with the local land office is mandatory. |

| Real estate purchase tax | 5% of the value of the property. | 1% of the value of the property. |

| Annual property tax | About 0,5% of the assessed value of the property. | Varies from 0.01% to 0.1% depending on cost and location. |

| Additional costs | The costs of document execution and legal services may amount to up to €1,000 - €2,000. | Legal and notary services will cost approx. €500 - €1,500. |

| Risks and limitations | There may be changes in legislation that may affect the lease rights. It is recommended to consult a lawyer to minimize risks. | The need to comply with the quota for foreign ownership in residential complexes. It is important to keep abreast of changes in legislation concerning foreigners. |

| Tax benefits | Tax incentives are possible for investors investing in infrastructure and tourism development. | Incentives are provided for investors developing tourism and economic zones. |

The legal and tax specifics in Indonesia and Thailand require careful research and preparation before purchasing a property. Each country has its own rules and restrictionsIt is recommended that you engage experienced legal counsel to ensure compliance with all local laws and regulations. It is advisable to engage experienced lawyers and consultants to ensure compliance with all local laws and minimize risks. Regardless of the country you choose, understanding the legal and tax nuances will help you make an informed decision and protect your investment.

What should an investor choose: Indonesia or Thailand?

Choosing between Indonesia and Thailand for real estate investment can be a daunting task as both countries offer unique opportunities and prospects. Let's take a look at the key factors that will help an investor make an informed decision.

Indonesia

Advantages

- Affordable real estate value: Indonesia offers lower real estate prices, especially in Lombok, where the cost per square meter starts from €800and in Bali, where prices range from. €2,000 to €3,500.

- Growth potential: Due to infrastructure development and increased tourist traffic, real estate prices are expected to rise steadily on the 3-5% per year.

- Cultural diversity and natural beauty: Indonesia attracts tourists with its unique islands and rich cultural heritage, which contributes to the demand for rental accommodation.

Disadvantages

- Legal restrictions: Foreigners can only purchase real estate on a lease for up to 80 yearsThis requires careful drafting and local lawyers.

- Political instability: Possible changes in legislation may affect leasehold rights and tenure.

Thailand

Advantages

- High rental yield: Due to the large flow of tourists, rental yields in Thailand can be as high as 8% p.a.especially in places like Phuket and Pattaya.

- Developed infrastructure and transportation: Thailand offers a well-developed road network and affordable public transportation, making the country an attractive place to live and do business.

- Stable economy: Thailand is experiencing steady economic growth, which creates a favorable environment for investment and business development.

Disadvantages

- High property values in popular neighborhoods: In Bangkok and Phuket, real estate prices can be as high as €6,500 per square meterThis makes them less accessible to investors with limited budgets.

- Restrictions on land ownership: Foreigners can own up to 49% apartments in one residential complex, which limits the opportunities for investment in land plots.

Conclusion

The bottom line is that both Indonesia and Thailand offer their own unique real estate investment opportunities. Choosing between these countries depends on your goals and preferences. If you are looking for more affordable options and are not afraid of risks, Indonesia can be a great choice. If, on the other hand, you prefer stability and high tourist traffic, Thailand may offer more options. Either way, it is worth thoroughly researching all aspects and consulting with experts before making a final decision. If you have any questions or would like more information, feel free to contact us.

Indonesia and Thailand are attracting investors due to their growing markets and tourism opportunities.

Bali offers a unique combination of beautiful beaches, cultural heritage and growing tourist traffic, making it attractive to investors.

Jakarta is developing rapidly and infrastructure improvements are boosting demand for real estate, making it a promising investment opportunity.

Lombok is under active development, offering more affordable prices and the potential for significant growth in the future.

Prices in Phuket range from $2500 to $6000 per square meter, depending on the area and type of property.

Foreigners can purchase apartments, but with restrictions on buying land and owning no more than 49% apartments in one complex.

Due to high tourist traffic, especially in Phuket and Pattaya, rental yields can be significant.

The purchase tax is 5% of the value and the annual property tax is about 0.5%.

The main risks include political and economic instability, currency fluctuations and inflation.

The choice depends on your goals: Indonesia offers affordable prices and growth potential, while Thailand offers stability and high tourist traffic.

Which countries are popular for real estate investment in Southeast Asia?

Indonesia and Thailand are attracting investors due to their growing markets and tourism opportunities.

Why is Bali a popular investment destination?

Bali offers a unique combination of beautiful beaches, cultural heritage and growing tourist traffic, making it attractive to investors.

What is the outlook for the real estate market in Jakarta?

Jakarta is developing rapidly and infrastructure improvements are boosting demand for real estate, making it a promising investment opportunity.

What advantages does Lombok offer to investors?

Lombok is under active development, offering more affordable prices and the potential for significant growth in the future.

What is the average cost of real estate in Phuket?

Prices in Phuket range from $2500 to $6000 per square meter, depending on the area and type of property.

What are the restrictions for foreign investors in Thailand?

Foreigners can purchase apartments, but with restrictions on buying land and owning no more than 49% apartments in one complex.

What are the rental yields in Thailand?

Due to high tourist traffic, especially in Phuket and Pattaya, rental yields can be significant.

What taxes do I need to consider when buying real estate in Indonesia?

The purchase tax is 5% of the value and the annual property tax is about 0.5%.

What are the risks of investing in real estate in Indonesia and Thailand?

The main risks include political and economic instability, currency fluctuations and inflation.

Which to choose for investment: Indonesia or Thailand?

The choice depends on your goals: Indonesia offers affordable prices and growth potential, while Thailand offers stability and high tourist traffic.