The Gulf real estate market beckons with its dynamism and opportunities. UAE and Qatar - two bright representatives of the region that offer investors unique perspectives. But where is it better to invest: in the shining skyscrapers of Dubai or in Doha, the progressive capital of Qatar? This is a question that concerns many people, and we will try to understand the nuances.

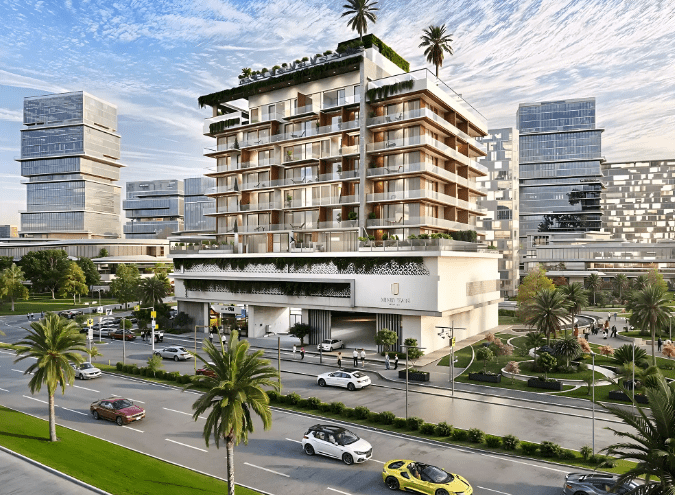

For investors, entrepreneurs and potential residentsThe choice between the UAE and Qatar could be a life-changing decision. UAE are known for their luxury projects such as Burj Khalifa and Palm Jumeirahwhere property values can range from 300,000 to several million euros. At the same time, Qatar is actively developing infrastructure following the successful WORLD CUP 2022.offering investments in new neighborhoods such as Lusailwhere prices start from 200,000 euros per apartment.

Analysis of the real estate market in the UAE

Main areas of focus

When it comes to UAE real estatecities that immediately come to mind include Dubai, Abu Dhabi and Ras Al Khaimah. Dubai - is the heart of investment, where new ambitious projects appear every year. For example, the district Downtown Dubai is famous for its luxury apartments, which can cost up to 500,000 euros for a studio. Abu Dhabi offers a quieter atmosphere with an emphasis on family residences. Here prices for a villa start from 700,000 euros. В Ras al-Khaymeh more affordable options can be found, which appeals to those seeking tranquility and proximity to nature.

Dynamics of prices and volumes of deals

The real estate market in the UAE continues to grow. Real estate prices in key areas of Dubai and Abu Dhabi are showing steady growth of 5-7% per annum. Interestingly, in 2024, transaction volume increased by 15% compared to the previous year. This indicates a high level of investor confidence in the market. Moreover, some analysts predict that demand will only increase in the coming years.

Influence of foreign investors

Foreign investors play a key role in market development. About 80% deals with real estate in the UAE are made by foreign citizens. This is due to the fact that the UAE offers attractive conditions for investment, including tax-free regime and the possibility of obtaining a resident visa. Due to this, many investors from Europe and Asia seek to purchase real estate in Dubai and other major cities.

Popular segments

Popular segments include apartments, villas and branded residences. Flats in DubaiEspecially in areas with developed infrastructure are always in demand. Villas attract families looking for comfort and space.

The role of tourism

Tourism in the UAE continues to be an important catalyst for the real estate market. Millions of tourists visit the country every year, driving demand for rental apartments and hotels. The number of tourists is projected to increase by 20% by 2025This will create additional opportunities for those considering buying a property to rent out.

Prospects for the future

All factors considered, UAE real estate market looks very promising. Ambitious plans to develop new neighborhoodssuch as Dubai Creek Harbour, are opening up new horizons for investors. The UAE continues to strengthen its position as one of the world's leading centers for real estate investment, and this makes the country attractive for long-term investments.

Analysis of the real estate market in Qatar

Main locations

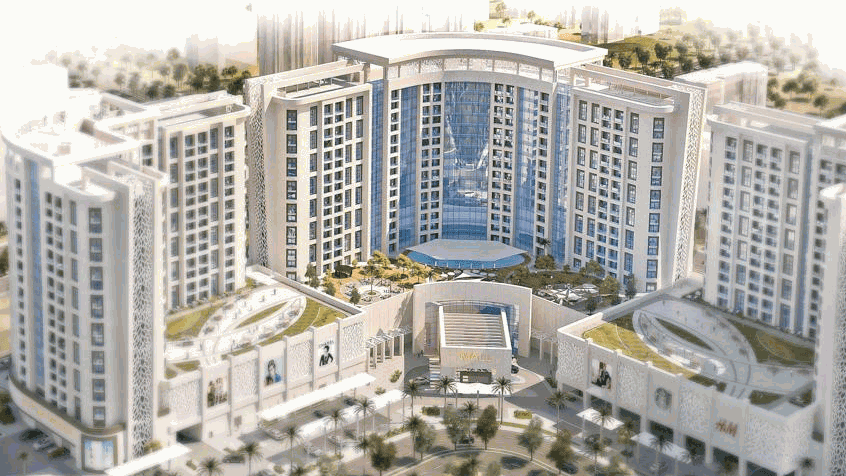

When we're talking about real estate in Qatarkey places that come to mind are Doha, Lusail and The Pearl. Doha - is the heart of the country, where both business and cultural centers are concentrated. Apartments here start from 250,000 euros. Lusail - is a new city that is actively developing and attracting the attention of investors. В The Pearl Luxury apartments and villas with sea views can be found, where prices can reach 1,000,000 euros.

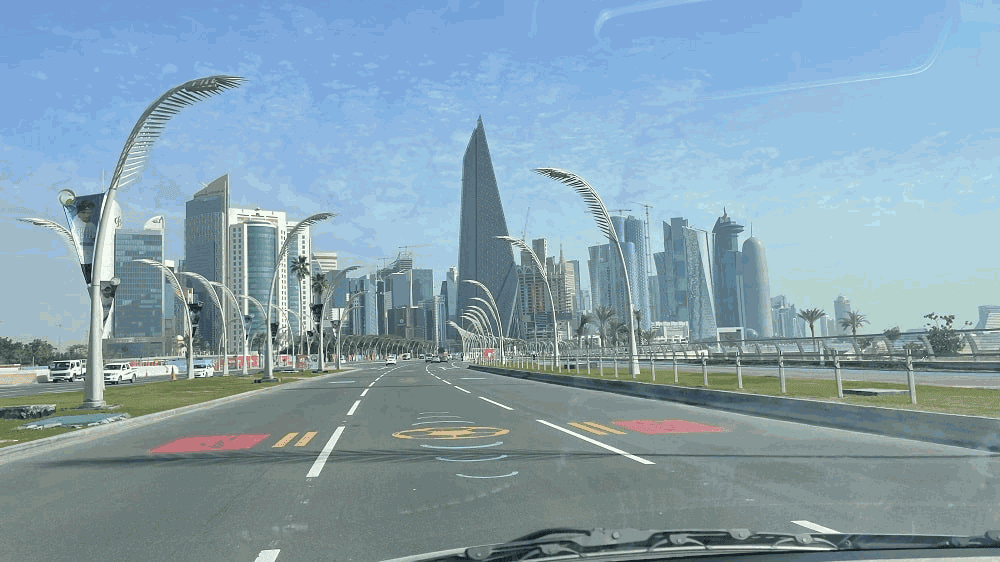

Infrastructure development after the World Cup 2022

After the World Cup, Qatar has made a powerful leap forward in infrastructure development. The construction of new roads, subways and social infrastructure has significantly improved transportation accessibility and quality of life. This has attracted new investors eager to capitalize on these changes. Interestingly, in some areas, real estate prices have increased by 10-12% since the championship ended.

Current trends and expansion plans

Qatar is actively working to expand and modernize existing areas. LusailFor example, it plans to become one of the largest cities in the country, offering innovative solutions for living and working. Office centers and residential complexes are being actively built here, which makes the city attractive to investors looking to invest in prospective property.

Investment and foreign capital attraction programs

Qatar offers a variety of programs for foreign investors. One of the most attractive is the program of obtaining a resident visa for the purchase of real estate from 200,000 euros. This makes the country particularly attractive to those considering long-term investment and those who want to live in the region.

Popular segments

Popular in the Qatari market are apartments, villas and commercial real estate. In recent years there has been an increase in interest in apartments in Lusail and The Pearl. Villas appeal to those looking for family living accommodation. Commercial real estate, especially in Doha, offers excellent business and investment opportunities.

Prospects for the future

All factors considered, real estate market in Qatar continues to evolve. The country is actively investing in new projects such as new residential areas and infrastructure improvements. This creates favorable conditions for the growth and development of the market, making Qatar attractive to investors looking for stable and promising investments.

Comparison of key investment drivers: UAE vs Qatar

| Factor | UAE | Qatar |

|---|---|---|

| Entry threshold: value of objects | From. 300,000 € (studios in Dubai) | From. 200,000 € (Lusail, The Pearl) |

| Price per 1 sq.m. on average | 3,000-5,500 € in Dubai, from 2,500 € in Abu Dhabi | 2,000-4,000 €In premium areas, Doha may be higher. |

| Liquidity: rental and resale | High: developed rental market, high resale activity | Medium: higher in premium projects, limited outside central zones |

| Payback (time) | Ages 5-8especially in high-demand areas | 7-10 years olddepending on the object and location |

| Rent per day, average | 80-200 €Depends on the neighborhood and the format. | 60-150 €especially at The Pearl and Lusaila. |

| Profit per year, on average | 6-8% p.a.in popular neighborhoods up to 10% | 5-7% p.a., high stability in certain areas |

| Formalization | Direct ownership (freehold) is available to foreigners in special zones | Possession is available, but occasional restrictions (e.g. leasehold or through a company) |

| Tax on the purchase of real estate | Registration fees from 0.5% to 4%depending on the emirate. | About 2-3% of the object's value |

| Possession tax (per year) | 0% - most emirates have no property tax | 0%but there may be annual maintenance fees. |

| Conditions for foreign investors | Open market, residency programs for purchases over a certain amount | Certain objects are available to investors, residence permit for investments is possible |

| Financial instruments | Wide selection mortgage programs for foreigners, loyal conditions | Mortgages are available, but more often residency requiredthe terms could be stricter |

| Annual growth of tourists | +5-8%Due to the growing popularity of Dubai and the development of new projects | +8-12%effect after the World Cup 2022, active development of tourism infrastructure |

| Real estate price growth per year | On average +4-7%in up-and-coming neighborhoods above | +3-6%especially in the newer areas (Lusail, Marina District). |

Financial instruments

For those considering mortgageThe UAE offers a variety of financial instruments. Banks actively cooperate with foreign buyers, offering mortgages with competitive rates. In Qatar, mortgage products are also available, but the conditions may be more stringent. It is important to carefully study all offers and choose the most suitable one.

Nuances when buying a home: UAE vs Qatar

Purchase procedure for foreigners

In UAE The process of buying real estate for foreigners is quite transparent. Buyers can purchase freehold real estate in designated areas such as Downtown Dubai or Palm Jumeirah. The process usually involves signing a purchase agreement and registering title, which can take up to several weeks. В Katare procedure is also available, but requires additional approvals, especially when it comes to strategically important areas such as The Pearl.

Legal status of property

In the UAE, foreign investors can own real estate on the rights of freeholdwhich gives full ownership rights. This allows owners to dispose of the property as they see fit. In Qatar, although freehold zones are also available, in some areas only freehold zones can be offered leaseholdwhich implies a lease for up to 99 years.

Financial requirements and mortgages

In UAE banks offer a variety of mortgage products for foreign buyers. Minimum down payment is usually around 25% of the value of the property. In Qatar, terms can be more stringent and banks often require a higher down payment. It is important to thoroughly research mortgage terms in both countries to choose the most favorable option.

Taxes and fees

In UAE buyers are exempt from property taxes, making the market particularly attractive. However, there are registration feewhich is about 4% of the transaction value. There are also no property taxes in Qatar, but there may be registration and paperwork fees that vary depending on the value of the property.

The role of realtors and lawyers

Working with professional realtors and lawyers is an important part of the real estate buying process in both countries. In the UAE, realtors help to find a suitable property and negotiate with sellers. In Qatar, however, legal support is particularly important due to the specifics of local legislation. Consulting with experienced professionals can help you avoid mistakes and protect your investment.

Additional costs

Buying real estate in the UAE and Qatar may include additional costs such as property maintenance and utility bills. In the UAE, for example, annual maintenance costs can be as much as 1-2% of the property's value. In Qatar, these costs also vary, depending on the type and location of the property. It is important to consider these costs when planning your budget.

Similarities and peculiarities of the real estate market

Regional specifics

Real estate markets in UAE and Qatar have their own unique features, but also have a lot in common. Both states strive to create a comfortable and modern environment for life and business. В UAE The emphasis is on innovation and luxury, as seen in projects like Burj Khalifa. QatarDeveloping after the 2022 FIFA World Cup, the city is focusing on sustainable development and cultural heritage.

Culture and legislation

Culture and legislation in both countries affect the real estate market. UAE are known for their more liberal attitude towards foreign investors, providing opportunities for full real estate ownership. В Katare There is also an openness to foreign investments, but with certain restrictions in strategic areas such as West Bay.

Types of objects and formats in demand

In UAE popular branded residences and villas by the sea. In Dubai, for example, you can find apartments from well-known brands such as Four Seasonspriced from 500,000 euros. В Katare The same demand for apartments and villas in areas such as The Pearlwhere the cost of housing starts from 300,000 euros. Both markets offer a variety of options for different categories of buyers.

Approach to construction and developers

Major real estate developers in UAEsuch as Emaar and Damacare known for their ambitious projects and high quality construction. They actively attract foreign investors due to their reputation. В Katare, real estate developers such as Barwa, focus on creating residential and commercial spaces with an emphasis on innovation and sustainability.

Buyer mentality

The mindset of the buyers in UAE and Qatar also has its own peculiarities. IN THE UAE. investors often look for properties to make a quick profit through rental or resale. В Katare However, many buyers are focused on long-term investments, given the stability and growth prospects of the market.

Impact of international events

International events such as trade shows and championships have a significant impact on the real estate market in both countries. В UAE The Expo attracted investors from all over the world, leading to an increase in rental demand. В KatareAfter the World Cup, there has been an increase in interest in real estate, which has encouraged the development of new projects and infrastructure.

Prospects for growth and development of resort real estate

Tourism as a catalyst

Tourism plays a key role in development resort real estate in the UAE and Qatar. В UAEEspecially in Dubai, millions of tourists arrive every year, driving demand for hotels and short-term rentals. Here the cost of apartments by the sea can start from 400,000 euros. В Katare After the World Cup 2022 there is an increase in tourist flow, which also has a positive impact on the real estate market.

Development of luxury segment

Luxury segment continues to be the focus of attention in both countries. В Dubai actively developing projects such as The World Islandswhere villas are for sale at prices starting from 1,000,000 euros. В Katare projects in The Pearl offer exclusive residences with sea views. These properties attract wealthy buyers looking for unique investment opportunities.

Branded projects

Branded projects are becoming increasingly popular. В UAEprojects such as Armani Residences in Dubai, offer a unique blend of luxury and style. В Katare similar projects are developed in partnership with global brands, which makes them especially attractive to international buyers seeking a high standard of living and service.

New development zones

The development of new zones is an important aspect for both markets. В UAE projects such as Dubai Creek HarbourThey promise to become new centers of attraction for investors. В Katare town Lusail is actively developing, offering investment opportunities in new residential and commercial developments.

Megaprojects and their impact

Megaprojects have a significant impact on the real estate market. UAE are known for their large-scale projects such as Palm Jumeirah. В Katare similar initiatives, such as the expansion of The PearlThese projects not only attract investors but also contribute to infrastructure development. These projects not only attract investors but also contribute to infrastructure development.

Prospects for the future

All factors considered, prospects for resort real estate development in the UAE and Qatar look promising. Ambitious plans to develop new tourist areas and improve infrastructure make both markets attractive for long-term investments. Demand for luxury properties and branded residences is only expected to grow, providing investors with excellent profit opportunities.

Yield from short-term and long-term leases

Comparison of rental income in Dubai and Doha

Rental market в Dubai and Doha offers different opportunities for investors. In Dubai, the demand for short-term rentals remains high due to the constant flow of tourists and businessmen. The average rental yield here is around 6-8% per annum. In Doha, where the market is more stable, yields can range from 5 to 7%, which is also attractive.

Airbnb and hotel licenses

In UAE many property owners use platforms such as Airbnbfor short-term rentals. It is important to remember that a special license is required in Dubaito legally rent out real estate through such services. В Katare The rules are stricter and many people prefer traditional forms of renting through agencies.

Impact of seasonality and events

Seasonality plays an important role in rental yields. В Dubai The high season is during the winter months, when the tourist flow increases. В Doha rental demand can increase significantly during major international events such as sports championships and exhibitions. This creates additional opportunities to increase rental income.

Long-term lease

Long-term rentals remain a stable source of income in both the UAEand in Katare. In Dubai, many expats prefer long term rentals, which provide stability and predictability of income. The situation is similar in Doha, where long-term rentals are popular with expatriate professionals and families.

Price ranges

Rental prices in Dubai can vary greatly depending on the neighborhood. For example, renting an apartment in Dubai Marina can cost from 1,500 euros a month. В Doha renting in prestigious neighborhoods such as West Baystarts at 1,200 euros a month. These figures emphasize the attractiveness of both markets for investors looking for stable income.

Growth Prospects

Given current trends, Rental yields in the UAE and Qatar will remain at a high level. Infrastructure development and growth of tourist flow contribute to the increase in demand for rental real estate. Investors can count on stable income and the possibility of increasing capitalization of their assets in the long term.

Economy and Life: UAE vs Qatar

UAE

Life in UAE attracts with its dynamism and comfort. Cost of living here varies from city to city. In Dubai, renting an apartment in the center can be from 1,500 euros per month, and the cost of food and entertainment will add about 800 euros more. However, the high cost is compensated for by the excellent infrastructure and level of service.

Quality of service in UAE at the top of its game. Numerous restaurants, shopping centers and entertainment venues make life here rich and interesting. This is especially evident in Dubai, which is famous for its luxurious shopping centers and world-class restaurants.

The lifestyle and climate in the UAE also have their own peculiarities. Climate here is hot and dry, especially in summer, when temperatures can reach 45 degrees Celsius. However, modern air-conditioned facilities and developed infrastructure make life comfortable at any time of the year.

Security is one of the key perks of living in the UAE. The country is known for its low crime rate and high level of security. This makes the UAE an attractive place to live for expats and investors.

Qatar

Qatar offers a more relaxed pace of life while maintaining a high level of comfort. Cost of living in Doha slightly lower than in Dubai. Renting an apartment in a good neighborhood can cost from 1,200 euros per month, and living expenses are around 700 euros.

The quality of service in Qatar is also at a high level. The country is actively developing its infrastructure, offering residents and visitors new opportunities for recreation and entertainment. Doha is particularly known for its cultural events and international exhibitions.

The climate in Qatar is similar to the UAE, but thanks to the landscaped cities and modern buildings, living here is comfortable even in the hottest months. Qatar is also famous for its beaches and seaside resortsThis makes it an attractive destination for tourists and residents.

Security in Qatar is also at the top. The low crime rate and high standard of living create a favorable living environment. This makes Qatar attractive to families and those seeking stability and comfort.

Education and Medicine: UAE vs Qatar

UAE

In UAE The education system offers a wide range of international schools and universities. In Dubai you can find schools such as Dubai International Academywhere a year of study costs 12,000-15,000 euros. The high level of teaching and variety of study programs make the UAE attractive for families with children.

Universities in the UAE, such as American University in Dubaioffer world-class programs. Tuition can range from 10,000 to 20,000 euros per year, depending on the program and specialization. This opens up many opportunities for professional growth and career advancement.

Medicine in the UAE is known for its high quality. Private clinics offer world-class services. Health insurance usually covers most medical services and the cost of a policy can start from €1,000 per year.

The level of medical care in the UAE continues to rise. Advanced technology and skilled professionals are available in Dubai and Abu DhabiThis makes the country attractive for medical tourism.

Qatar

Medicine in Qatar is also at a high level. Private and public clinics offer a wide range of medical services. Insurance policies, which start at 800 euros per year, cover most necessary medical procedures.

The level of medical care in Qatar continues to improve, with a focus on innovation and advanced treatments. This makes Qatar attractive to those who value high quality medical services.

Qatar also offers high quality education. Doha is home to international schools such as Doha CollegeQatar is the only country in the world where the cost of education is around 10,000-13,000 euros per year. This makes Qatar attractive to foreigners seeking to provide their children with a quality education.

Universities in Qatar, including Qatar UniversityThere are a variety of programs in English. The cost of studying here can be lower than in the UAE, starting from 8,000 euros per year. This opens doors for students from all over the world.

Roads and Transportation: UAE vs Qatar

UAE

Transportation infrastructure in UAE is known for its development and modernity. Dubai is home to subwaywhich covers the main districts of the city. The fare starts at 1 euro, making it an affordable and convenient means of transportation. Dubai Metro is renowned for its cleanliness and efficiency.

Road development in the UAE is impressive. Highways connect key cities such as Dubai and Abu Dhabi. Driving here is comfortable and the quality of roads meets world standards. Rent a car can cost from 30 euros per day, making it easy to explore the country.

Airports in the UAE, such as Dubai International Airport, offer a wide range of international flights. This makes the country an important transportation hubproviding easy access to most of the world's capitals.

Convenience of traveling within the country is also ensured by an extensive network of cab and bus routes. Cab in Dubai is a comfortable and affordable way to travel, with a minimum trip cost of about 3 euros.

Qatar

In Katare The transportation system is also being actively developed. A new line has recently opened in Doha subwaywhich connects key areas of the city. The fare is about 0.5 euros, making it popular with locals and tourists.

Road infrastructure in Qatar continues to improve. Construction of new highways and interchanges makes traveling around the country fast and comfortable. Rent a car in Doha is also available, starting at €25 per day.

Hamad International Airport in Doha is one of the most modern airports in the world. It offers convenient flights to most major cities. This makes Qatar a convenient place to travel and do business.

Domestic transportation in Qatar is also represented by buses and cabs. Cab is available at any time of the day, with a minimum trip cost of about 2 euros, which provides convenience and comfort of traveling around the city.

Legal and tax specifics: UAE vs Qatar

UAE

In UAE the legal system offers significant advantages for foreign investors. Taxation here is absent on rental income, which makes the market particularly attractive. This allows investors to earn a net profit without incurring additional tax costs.

Visas and residence permits in the UAE are available through real estate investments. If you buy a property worth 500,000 euros or more, you can get a 5-year residency visa. This opens the door for long-term residence and work in the country.

The legal status of property in the UAE varies. Freehold Allows foreigners to own real estate in certain zones such as Downtown Dubai. This gives full authority to dispose of the property and guarantees investment protection.

Real estate registration is quick and transparent. The registration fee is about 4% of the value of the property and is usually paid by the buyer. This simplifies the process and secures the transaction.

Qatar

In Katare tax policy is also favorable for investors. Real estate taxes no, which makes it possible to receive rental income without additional deductions. This creates favorable conditions for investment and budget planning.

Visas and residency programs in Qatar are also available for investors. With an investment in real estate of 200,000 euros or more, you can apply for a resident visa. This makes the country attractive for long-term residence and business.

The legal status of property in Qatar can be either freeholdas well as leaseholdDepending on the neighborhood. In key areas such as The PearlForeigners can own real estate on a freehold basis, which ensures that their rights are fully protected.

Purchase procedure real estate in Qatar is also transparent and regulated by the government. Usually registration fees are around 2-3% of the value of the property. This guarantees the safety and reliability of transactions in the market.

What should an investor choose: UAE or Qatar?

UAE

UAE attract investors because of their dynamism and diversity of opportunities. DubaiWith its developed infrastructure and high quality of life, it is ideal for those looking for quick returns and a high level of service. Short-term investments here can be very profitable due to the constant influx of tourists and expats. The cost of properties varies, but attractive options can be found from 300,000 euros.

Long-term prospects in the UAE are also pleasing. Continuous development of new projects such as Dubai Creek HarbourThis makes the country attractive to investors looking for stability and long-term investments. This makes the country attractive to investors looking for stability and long-term investments.

Qatar

Qatar offers a calmer and more stable market. Doha and its environs are being developed with a focus on sustainability and cultural heritage. Long-term investments in Qatar can bring a stable income due to rising real estate prices and improving infrastructure. Lusail and The Pearl - are neighborhoods where you can find quality housing from 200,000 euros.

Short-term strategies in Qatar can also be effective, especially in light of the increase in tourist flow after major international events. However, investors should take into account the specifics of the local market and legislative peculiarities.

Outlook for 2025-2030.

Taking all factors into account, both markets offer unique opportunities for investors. UAE will continue to develop as a global business and tourism center, offering high yields and a diversity of facilities. QatarIn turn, it will focus on sustainable development and cultural projects, which will also attract the attention of investors looking for stability and quality.

Ultimately, the choice between the UAE and Qatar depends on your investment goals and preferences. Each country offers its own unique benefits, and understanding them will help you make the right choice.

There are no taxes on rental income in the UAE, allowing investors to make a net profit. This is one of the main advantages for investments.

Yes, if you buy a property of 200,000 euros or more in Qatar, you can get a resident visa, making the country attractive for long-term residency.

Apartments, villas and branded residences are popular in the UAE. There is a particular demand for properties in areas with developed infrastructure.

The average rental yield in Dubai is around 6-8% per annum, making it attractive for short and long term investments.

In the UAE foreigners can own freehold property in certain areas, in Qatar - also available freehold, but there are restrictions in strategic areas.

Both countries have hot and dry climates, especially in summer. However, modern infrastructure and air conditioning make life comfortable.

The UAE will continue to develop tourism and business centers, while Qatar will focus on sustainable development and cultural projects, attracting investors.

Dubai, Abu Dhabi and Ras Al Khaimah are popular in the UAE. Dubai attracts luxury projects, Abu Dhabi - family residences, Ras Al Khaimah - affordability.

Dubai offers developed infrastructure, a high standard of living and tax-free rental income. This makes it attractive to foreign investors.

In Qatar, the promising areas are Doha, Lusail and The Pearl. They offer new projects and improved infrastructure after the World Cup 2022.

What are the tax advantages of investing in the UAE?

There are no taxes on rental income in the UAE, allowing investors to make a net profit. This is one of the main advantages for investments.

Can I get a resident visa when buying real estate in Qatar?

Yes, if you buy a property of 200,000 euros or more in Qatar, you can get a resident visa, making the country attractive for long-term residency.

Which real estate properties are popular in the UAE?

Apartments, villas and branded residences are popular in the UAE. There is a particular demand for properties in areas with developed infrastructure.

What is the average rental yield in Dubai?

The average rental yield in Dubai is around 6-8% per annum, making it attractive for short and long term investments.

What are the differences between the rules for buying real estate for foreigners in the UAE and Qatar?

In the UAE foreigners can own freehold property in certain areas, in Qatar - also available freehold, but there are restrictions in strategic areas.

What features of the climate in the UAE and Qatar can affect life?

Both countries have hot and dry climates, especially in summer. However, modern infrastructure and air conditioning make life comfortable.

What development is expected in the UAE and Qatar in the coming years?

The UAE will continue to develop tourism and business centers, while Qatar will focus on sustainable development and cultural projects, attracting investors.

What are the main areas for real estate investment in the UAE?

Dubai, Abu Dhabi and Ras Al Khaimah are popular in the UAE. Dubai attracts luxury projects, Abu Dhabi - family residences, Ras Al Khaimah - affordability.

What are the benefits of buying real estate in Dubai?

Dubai offers developed infrastructure, a high standard of living and tax-free rental income. This makes it attractive to foreign investors.

What are the most promising areas in Qatar for investment?

In Qatar, the promising areas are Doha, Lusail and The Pearl. They offer new projects and improved infrastructure after the World Cup 2022.