Nowadays, Turkey and the UAE are attracting the attention of investors from all over the world due to their dynamic real estate markets. These countries offer a variety of opportunities for those looking for both a profitable investment and a comfortable place to live. But what are the key differences between these two destinations? And which to choose: the sunny beaches of Turkey or the futuristic horizons of the UAE? In this article, we will take a detailed look at the real estate market in both countries to help you make an informed choice.

Analysis of the real estate market in Turkey and UAE

Turkey and the UAE continue to be at the forefront of investor interest, offering unique real estate investment opportunities. Let's take a closer look at how the market is doing in each of these countries.

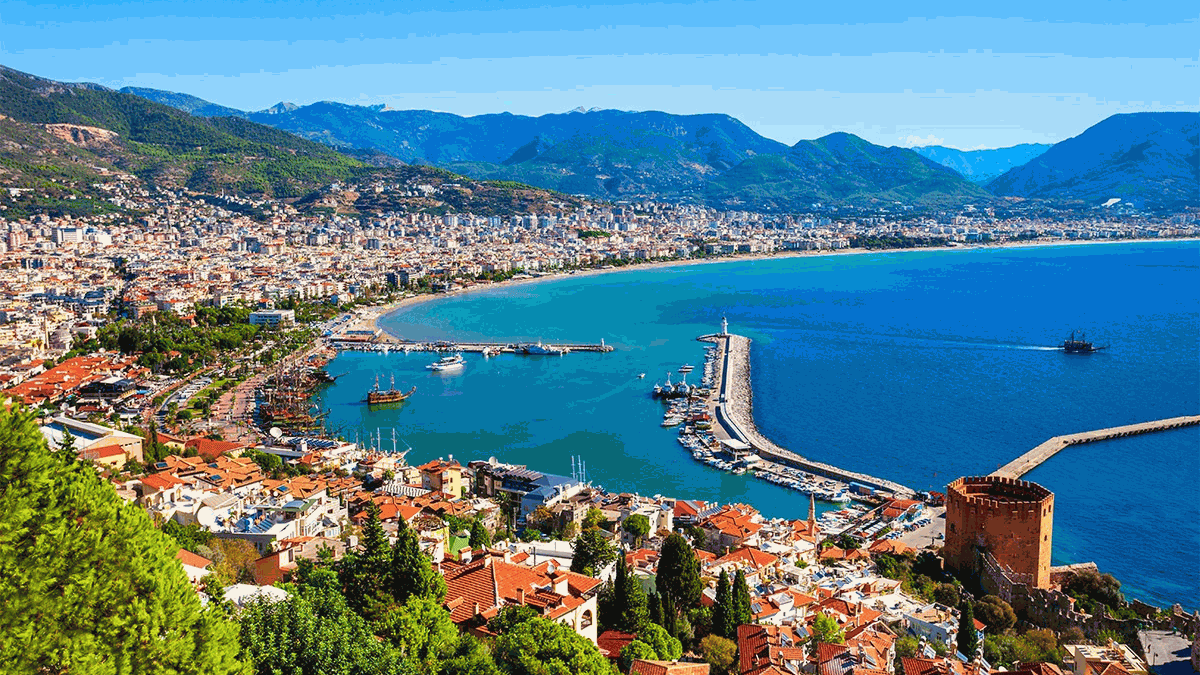

Turkey

Over the past few years, the real estate market in Turkey has shown steady growth. IstanbulAs the economic and cultural center of the country, Istanbul attracts attention due to its diverse offerings ranging from modern apartments to historical buildings. The average cost per square meter in Istanbul is about 2,000 eurosThis makes it attractive to investors looking for a balance between price and quality.

Resort areas such as Antalya and BodrumThe average price per square meter here is around the region. Here the average price per square meter varies in the region of 1,500 euros. These regions attract not only tourists, but also those looking for a stable rental income opportunity.

UAE

The real estate market in the UAE, especially in the DubaiDubai is famous for its rapid development and innovative projects. In recent years, real estate prices here have stabilized, and now the average cost per square meter in Dubai is about 3,500 euros. This makes Dubai one of the most expensive cities for investment in the region.

Abu Dhabi is also not lagging behind, offering investors a variety of options, from luxury villas to modern apartments. On average, the cost per square meter here is 3,000 euros. Investments in real estate in the UAE remain attractive due to high standards of living and a stable economic situation.

Impact of foreign investment

Foreign investment plays a key role in the development of both markets. In Turkey, the government actively supports foreign buyers by offering residence permit programs through the purchase of real estate. In the UAE, despite stricter regulations, foreigners can purchase real estate in specially designated zones, which makes the market accessible to international investors.

Comparison of key investment factors

When it comes to choosing between Turkey and the UAE for real estate investment, it is important to consider several key factors: the level of profitability, the liquidity of objects, the return on investment and the cost of real estate in different regions. Let's take a closer look at each of them.

| Factor | Turkey | UAE |

|---|---|---|

| Price per 1 sq.m. on average | Istanbul - 2,000 € Resort areas - 1,500 € | Dubai - 3,500 € Abu Dhabi - 3,000 € |

| Formalization | Relatively simple procedure | Quick clearance, in some cases tax-free zones |

| Tax on the purchase of real estate | 4% from the cost | 4% (Dubai) |

| Real estate ownership tax, per year | Absent | None (in most emirates) |

| Rate of return (rental) | 5-7% p.a. | 6-8% p.a. |

| Liquidity of facilities | High (especially in large cities and resort areas) | High (especially in Dubai and Abu Dhabi) |

| Payback | 12-15 years old | 10-12 years old |

| Rent per day, average | Istanbul - 50-100 € Antalya - 40-80 € | Dubai - 100-200 € Abu Dhabi - 80-150 € |

| Profit per year, on average | 5-7% | 6-8% |

| Annual growth of tourists | +10-15% | +5-10% |

| Real estate price growth per year | 5-10% | 7-12% |

Turkey offers more affordable real estate prices and stable returns, making it a good option for long-term investors. The UAE, especially Dubai, attracts high yields, quick payback and liquidity, but requires large investments.

Nuances when buying a home

Purchasing real estate in Turkey and the UAE has its own unique features and restrictions that potential buyers need to consider. Let's consider the key aspects that will help you make the right choice.

Turkey

Who can buy real estate? In Turkey, foreigners can freely purchase real estate, with the exception of land plots in rural areas and border zones. This makes the market accessible to most international investors.

Minimum investment amount: To obtain a residence permit through the purchase of real estate, the minimum investment amount is approx. 400,000 euros. This condition makes Turkey attractive to those considering relocation and obtaining a residence permit.

Popular neighborhoods to buy in: In Istanbul, the popular districts of Beşiktaş and Şişli, where the price per square meter ranges from 2,500 to 3,500 euros. In Antalya and Bodrum, many buyers choose real estate near the coast, where prices are more affordable, ranging from . 1,500 euros per square meter.

UAE

Who can buy real estate? In the UAE, foreigners can only purchase real estate in designated areas such as Dubai Marina and Downtown Dubai. This limitation should be taken into account when selecting a property for investment.

Minimum investment amount: To obtain a UAE residence permit through the purchase of real estate, the minimum investment amount is approx. 500,000 euros. This makes the UAE a more expensive choice, but with higher status and opportunities.

Popular neighborhoods to buy in: Neighborhoods remain popular in Dubai Palm Jumeirah and Downtown, where the cost per square meter can reach 5,000 euros. In Abu Dhabi, many investors choose Sadiyat Island and Al Reem Island, where prices range from . 3,000 to 4,000 euros per square meter.

Similarities and peculiarities of the real estate market in Turkey and the UAE

The Turkish and UAE real estate markets have both similarities and unique features that may affect your buying decision. Let's get into the details.

Turkey

Infrastructure developmentTurkey is actively investing in infrastructure development, which has a positive impact on the real estate market. In recent years, new airports, roads and bridges have been built in the country, which makes traveling around the country more convenient. This is especially noticeable in major cities such as Istanbul and Ankara, where transportation accessibility plays a key role in real estate choices.

The role of state regulationThe Turkish government actively supports the real estate market by offering various programs for foreign investors, including the possibility of obtaining a residence permit through the purchase of real estate. These measures help to attract foreign capital and develop the market.

Availability of mortgages and installments: In Turkey, foreigners can take advantage of mortgages, but the conditions may vary from bank to bank and region to region. The average mortgage interest rate is about 8-10% p.a.. Installment payments are also available, making the purchase more flexible and affordable.

UAE

Infrastructure development: The UAE is renowned for its large-scale infrastructure projects. Dubai and Abu Dhabi offer state-of-the-art transportation systems, including subways, expressways and international airports, making getting around fast and comfortable.

The role of state regulation: In the UAE, the real estate market is strictly regulated by the government, which ensures a high level of transparency and investor protection. This creates favorable conditions for investments and contributes to market stability.

Availability of mortgages and installments: In the UAE, foreigners can also get a mortgage, but the requirements for borrowers may be stricter. The average mortgage interest rate is about 4-5% p.a.This makes it more affordable compared to Turkey. Installment payments are also offered by many developers, allowing investors the flexibility to manage their finances.

Prospects for growth and development of resort real estate

Resort real estate in Turkey and the UAE continues to attract the attention of both investors and buyers looking for an ideal vacation destination. Let's take a look at how this market segment is developing in both countries and what prospects it offers.

Turkey

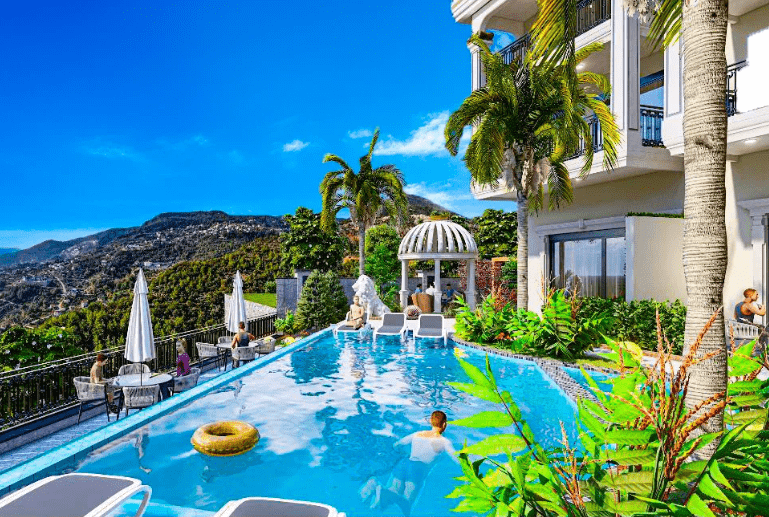

How is the real estate market developing on the coast? Turkey is famous for its picturesque coasts and resort towns such as Antalya, Bodrum and Fethiye. These regions continue to develop aggressively, offering new residential developments and improved infrastructure. Investors note stable demand for resort real estate, which supports price growth.

Tourist flow and its impact on prices: Turkey remains one of the most popular tourist destinations in the world. Millions of tourists visit the country every year, which creates a steady demand for rental accommodation. This, in turn, drives up real estate prices in resort areas. The average cost of a square meter in Antalya is approx. 1,500 euroswhich makes it affordable for investors.

Forecasts for the next 5-10 years: The resort real estate market in Turkey is expected to continue to grow due to the steady influx of tourists and improved infrastructure. Investors can expect stable rental income and an increase in the value of the properties in the long term.

UAE

How is the real estate market developing on the coast? In the UAE, resort real estate is concentrated in areas such as Palma Jumeirah and Jumeirah Beach Residence in Dubai. These neighborhoods offer luxury properties and upscale amenities, making them attractive to affluent buyers.

Tourist flow and its impact on prices: The UAE, and Dubai in particular, remains a popular tourist destination due to its unique attractions and world-class events. This contributes to high demand for resort rental properties and keeps prices rising. The average cost per square meter in popular resort areas can be as high as 5,000 euros.

Forecasts for the next 5-10 years: The resort real estate market in the UAE is expected to continue to grow due to continuous investments in infrastructure and tourism industry. Investors can count on high rental yields and long-term growth in property values.

Yield from short-term and long-term leases

The real estate rental market in Turkey and the UAE offers investors a variety of income opportunities, be it short-term rentals for tourists or long-term contracts with locals. Let us consider what prospects and features are characteristic of each of the countries.

Turkey

Average yield in percent: Turkey offers stable returns on rental properties. In large cities such as Istanbul, long-term rental yields can be as high as 5-7% p.a.. In resort areas such as Antalya and Bodrum, short-term rentals to tourists can generate even higher revenues, especially during the high season.

Seasonality of the rental business: Turkey's resort regions are subject to seasonal fluctuations. The summer months generate the most revenue when the flow of tourists is at its peak. At this time, rental values can increase by 20-30%, allowing investors to significantly increase their returns.

Which cities are suitable for short-term rentals and which cities are suitable for long-term rentals?: Istanbul and Ankara are ideal for long-term rentals due to the high demand from locals and expats. Antalya and Bodrum, on the other hand, are best suited for short-term rentals, especially in the summer season when the tourist flow is most intense.

UAE

Average yield in percent: In the UAE, rental yields also remain high. In Dubai, long-term rental yields can be as high as 6-8% p.a.This makes it attractive to investors focused on stable income.

Seasonality of the rental business: Unlike Turkey, the UAE rental market is less prone to seasonal fluctuations due to the year-round flow of tourists and business travelers. This provides a stable income throughout the year, which is a significant advantage for investors.

Which cities are suitable for short-term rentals and which cities are suitable for long-term rentals?: Dubai is an ideal location for short term rentals due to its status as an international tourist and business center. Abu Dhabi, on the other hand, is more suitable for long-term rentals due to the high demand from locals and employees of large companies.

Economy and Life

The choice of country for real estate investment often depends not only on market indicators, but also on the general standard of living, economic stability and the cost of everyday expenses. Let's take a look at the situation in Turkey and the UAE in this regard.

Turkey

Cost of living: Turkey offers a relatively low cost of living compared to Europe and the Gulf countries. The average monthly expenditure for a family of four in Istanbul is approx. 1,500-2,000 eurosincluding rent, food and transportation. This makes Turkey attractive to those looking for comfortable accommodation at an affordable price.

Income level of the local population: The average salary in Turkey is about 600-800 euros per month, which is somewhat lower than in EU countries. However, this is compensated for by the low cost of living, which provides an acceptable level of comfort for local residents.

Inflation and currency stability: The Turkish lira is subject to fluctuations and inflation remains an important factor affecting the country's economy. Investors should consider currency risks when investing in Turkish real estate. Nevertheless, the government is taking measures to stabilize the economy and strengthen the national currency.

UAE

Cost of living: The UAE, and especially Dubai, is known for its high standard of living and associated costs. The average monthly expenses for a family of four in Dubai can be as high as 3,000-4,000 euroswhich includes rent, food and transportation. This makes the UAE a more expensive choice for accommodation, but with a high level of comfort and services.

Income level of the local population: The average wage in the UAE is approx. 3,000-4,000 euros per month, which is significantly higher than in Turkey. This is due to the high level of economic development and the presence of many international companies.

Inflation and currency stability: The UAE Dirham is pegged to the US dollar, which ensures currency stability and low inflation. This creates favorable conditions for investment and reduces currency risks.

Education and medicine

Choosing a country for real estate investment also often depends on the level of education and medical services available in the region. Let's take a look at what opportunities Turkey and the UAE offer in these important areas.

Turkey

Accessibility of private and public schools: There is a wide range of both public and private educational institutions in Turkey. International schools such as the British International School in Istanbul offer high quality education of international standards. The cost of private school tuition can range from 5,000 to 15,000 euros per year, depending on the level and prestige of the institution.

Level of medical care: Turkey is known for its quality medical services, especially in the major cities. Many medical facilities are accredited by international organizations, which confirms the high level of service provided. The cost of medical services remains affordable and the health care system offers both public and private clinics.

Insurance and medical expenses for residents: Foreigners living in Turkey can take out health insurance which covers most medical expenses. The average cost of annual insurance is approx. 500-1,000 eurosdepending on the selected service package.

UAE

Accessibility of private and public schools: The UAE, and especially Dubai, is home to some of the best international schools in the region. Educational institutions such as the International School of Dubai offer IB and A-Level academic programs. The cost of tuition at such schools can be as high as 10,000-25,000 euros per year.

Level of medical care: UAE offers high quality medical services that meet international standards. Hospitals and clinics are equipped with modern equipment and offer a wide range of medical services. This makes the UAE an attractive place to live in terms of healthcare.

Insurance and medical expenses for residents: Health insurance is compulsory for all UAE residents. The cost of annual insurance can vary from 1,000 to 3,000 eurosDepending on the selected coverage and insurer.

Roads and transportation

Transportation infrastructure plays a key role in choosing a country for real estate investment, as it directly affects the quality of life and ease of movement. Let's take a look at what opportunities Turkey and the UAE offer in this regard.

Turkey

Level of development of public transportation: Turkey, especially in major cities such as Istanbul and Ankara, offers a well-developed public transportation system. Subways, streetcars and buses provide convenient and affordable transportation around the city. The cost of public transportation in Istanbul is approx. 0.50 euros per trip, making it a cost-effective option.

Availability of international flights: Istanbul is one of the largest aviation hubs in the world, providing excellent accessibility to international flights. Istanbul's new airport offers flights to more than 300 destinations worldwidewhich makes it convenient for frequent travel.

Cost of cars and fuel: In Turkey, the cost of cars is slightly higher than in Europe due to high import taxes. The average price of a new mid-range car is approx. 20,000-25,000 euros. The cost of fuel fluctuates around 1.50 euros per liter, making car ownership affordable, but not cheap.

UAE

Level of development of public transportation: The UAE, especially Dubai, offers one of the most modern transportation systems in the world. Dubai Metro, buses and streetcars provide a quick and comfortable way to get around the city. The cost of a subway ride is approx. 1 euromaking it affordable for most residents.

Availability of international flights: Dubai and Abu Dhabi are important aviation hubs, offering direct flights to most major cities in the world. Dubai Airport is one of the busiest in the world, making international travel easy.

Cost of cars and fuel: In UAE, cars are available at better prices due to low taxes. The average cost of a new mid-range car is approx. 15,000-20,000 euros. The cost of fuel in the UAE is one of the lowest in the world, approx. 0.70 euros per liter, making car ownership very economical.

Legal and tax specifics

Acquiring real estate abroad requires careful study of legal and tax aspects to avoid unexpected complications. Let us consider what peculiarities exist in Turkey and the UAE.

Turkey

Taxes on the purchase of real estate: In Turkey, purchasers of real estate are required to pay transfer tax, which amounts to 4% of the declared value of the object. This tax is usually split between the buyer and seller, but in some cases may be borne entirely by the buyer.

Possession and sales tax: Ownership of real estate in Turkey is subject to an annual property tax, which is from 0.1% to 0.6% of the estimated value of the objectDepending on its location. When a property is sold, if it has been owned for less than five years, capital gains tax is levied, which can be as high as 35% from the difference between purchase and sale price.

Residence permit and citizenship through the purchase of real estate: Turkey offers a program for obtaining a residence permit through the purchase of real estate with a value of from 400,000 euros. This allows investors and their families to reside in the country permanently and paves the way for citizenship after a few years.

UAE

Taxes on the purchase of real estate: In the UAE, the purchase of real estate is subject to a registration fee of 4% of the object value. This fee is usually paid by the buyer and is a one-time charge.

Possession and sales tax: There is no real estate ownership tax in the UAE, making it attractive to investors seeking to minimize tax liabilities. There is also no capital gains tax on the sale of real estate, which allows you to retain a large portion of your profits.

Residence permit and citizenship through the purchase of real estate: UAE offers a two-year resident visa on the purchase of real estate valued at from 500,000 euros. This gives investors the right to reside in the country, but does not provide an automatic path to citizenship, which remains quite difficult to obtain.

What should an investor choose?

An investor considering the purchase of real estate abroad always faces a difficult choice. Turkey and the UAE offer different opportunities and conditions, and the final decision depends on your goals and preferences. Let's summarize and highlight the key points.

Final comparison of Turkey and UAE

UAE:

- High standard of living: The UAE, especially Dubai, offers a high standard of living and modern facilities for business and leisure.

- No ownership taxes: The absence of taxes on the ownership and sale of real estate makes the UAE attractive to investors seeking to minimize tax liabilities.

- High rental yield: Rental yields in Dubai can be as high as 6-8% p.a.which makes investing in real estate here particularly profitable.

Turkey:

- AvailabilityTurkey offers more affordable real estate prices, especially in resort areas such as Antalya and Bodrum, where the cost per square meter starts from 1,500 euros.

- Flexibility in obtaining a residence permit: Possibility of obtaining a residence permit through the purchase of real estate with a value from 400,000 euros makes Turkey attractive for those planning a long-term stay.

- Stable rental income: The average rental yield is 5-7% p.a.which provides a steady income.

Which market is more favorable for short-term and long-term investments?

For short-term investments, Turkey offers attractive opportunities due to seasonal rental peaks in resort areas. This allows investors to earn high returns during the summer season.

For long-term investments, the UAE offers stability and a high standard of living, making it ideal for those who plan to hold assets for a long time.

What's best for life and what's best for business?

For life: Turkey offers more affordable living and residence permit conditions, which makes it attractive for families and retirees.

For business: The UAE, with its developed infrastructure and no income taxes, is an ideal choice for doing business and living in a high level of comfort.

Conclusion

In conclusion, choosing between Turkey and UAE for real estate investment depends on your individual goals and preferences. Turkey attracts by the affordability of prices and the possibility of obtaining a residence permit through the purchase of real estateThis makes it attractive to those looking for a comfortable place to live and a stable rental income. The UAE, with its high standard of living and no ownership taxes, offers unique business opportunities and high returns.

Each country has its own advantages and characteristics that may suit different investment strategies. Thorough market research, consideration of all legal and tax nuances, and an understanding of your long-term plans will help you make the right choice.

If you have any questions or would like further advice, do not hesitate to contact us. We are always ready to help you with your choice and provide up-to-date information about the real estate market in Turkey and the UAE. Contact us and we will help you make a favorable and informed investment decision.

Turkey offers more affordable prices and flexible conditions for obtaining a residence permit, while the UAE attracts with its high standard of living and lack of taxes on ownership.

Average rental yields in Turkey are around 5-7% per annum, making it attractive to investors looking for a stable income.

In Turkey, a property transfer tax of 4% and an annual property tax of 0.1% to 0.6% must be considered.

To obtain a residence permit in the UAE requires the purchase of real estate worth 500,000 euros or more, which entitles you to a resident visa for two years.

In popular areas of Dubai, such as Palm Jumeirah, the cost per square meter can reach 5,000 euros.

The cost of living in Turkey is significantly lower than in the UAE. The average monthly expenses per family in Istanbul are around 1,500-2,000 euros.

Antalya and Bodrum are ideal for short-term rentals due to the high tourist flow during the summer season.

The average cost of tuition at UAE international schools can be as high as €10,000-25,000 per year.

Turkey offers affordable real estate prices, stable rental income and the possibility of obtaining a residence permit, which makes it attractive for long-term investment.

The UAE attracts a high standard of living, the absence of taxes on the ownership and sale of real estate, as well as developed infrastructure, which creates favorable conditions for business.

What are the main differences between the real estate markets of Turkey and the UAE?

Turkey offers more affordable prices and flexible conditions for obtaining a residence permit, while the UAE attracts with its high standard of living and lack of taxes on ownership.

What is the average rental yield in Turkey?

Average rental yields in Turkey are around 5-7% per annum, making it attractive to investors looking for a stable income.

What taxes do I need to consider when buying real estate in Turkey?

In Turkey, a property transfer tax of 4% and an annual property tax of 0.1% to 0.6% must be considered.

What are the conditions for obtaining a residence permit in the UAE through the purchase of real estate?

To obtain a residence permit in the UAE requires the purchase of real estate worth 500,000 euros or more, which entitles you to a resident visa for two years.

What is the cost per square meter in popular areas of Dubai?

In popular areas of Dubai, such as Palm Jumeirah, the cost per square meter can reach 5,000 euros.

How does the cost of living in Turkey compare to the UAE?

The cost of living in Turkey is significantly lower than in the UAE. The average monthly expenses per family in Istanbul are around 1,500-2,000 euros.

Which cities in Turkey are suitable for short-term rentals?

Antalya and Bodrum are ideal for short-term rentals due to the high tourist flow during the summer season.

What is the average cost of tuition at UAE international schools?

The average cost of tuition at UAE international schools can be as high as €10,000-25,000 per year.

What advantages does Turkey offer for long-term investments?

Turkey offers affordable real estate prices, stable rental income and the possibility of obtaining a residence permit, which makes it attractive for long-term investment.

Why is the UAE considered attractive for doing business?

The UAE attracts a high standard of living, the absence of taxes on the ownership and sale of real estate, as well as developed infrastructure, which creates favorable conditions for business.