Rules for paying VAT in Northern Cyprus

Real Estate Specialist

In the modern world, where real estate is one of the main assets, it is important to understand all the nuances associated with its acquisition. Special attention should be paid to taxation issues, in particular, the payment of VAT. How to calculate this tax correctly depends not only on the legality of the transaction, but also on the financial benefit from the purchase. An important aspect is to understand the difference between the cadastral value and the real value of real estate, since the amount of VAT paid depends on these indicators.

Basic concepts

Cadastral value — this is an assessment of the value of real estate carried out by state bodies for tax purposes. It is based on a number of parameters, including the location, size, type, and state of the object. It is important to understand that the cadastral value may differ significantly from the market value. However, it is an officially recognized indicator used for calculating taxes and other payments.

Real cost — this is the price that the buyer is willing to pay for real estate on the open market. It depends on many factors, including supply and demand, the economic situation in the country and region, the infrastructure of the district, and many others. The real value may differ significantly from the cadastral value, which creates certain difficulties in calculating VAT.

Market value — this is another important indicator that reflects the current economic situation in the real estate market. It is determined based on a comparison of transactions for the sale of similar properties in a given region. The market value can be used as an argument when negotiating a price or when appealing the amount of taxes.

VAT (Value Added Tax) — this is a tax that is levied on the cost of goods and services at each stage of their production and sale. In case of purchase of real estate, VAT is calculated from the transaction value and paid by the buyer. The amount of VAT and the procedure for its payment are regulated by the tax legislation.

Legislative framework of Northern Cyprus

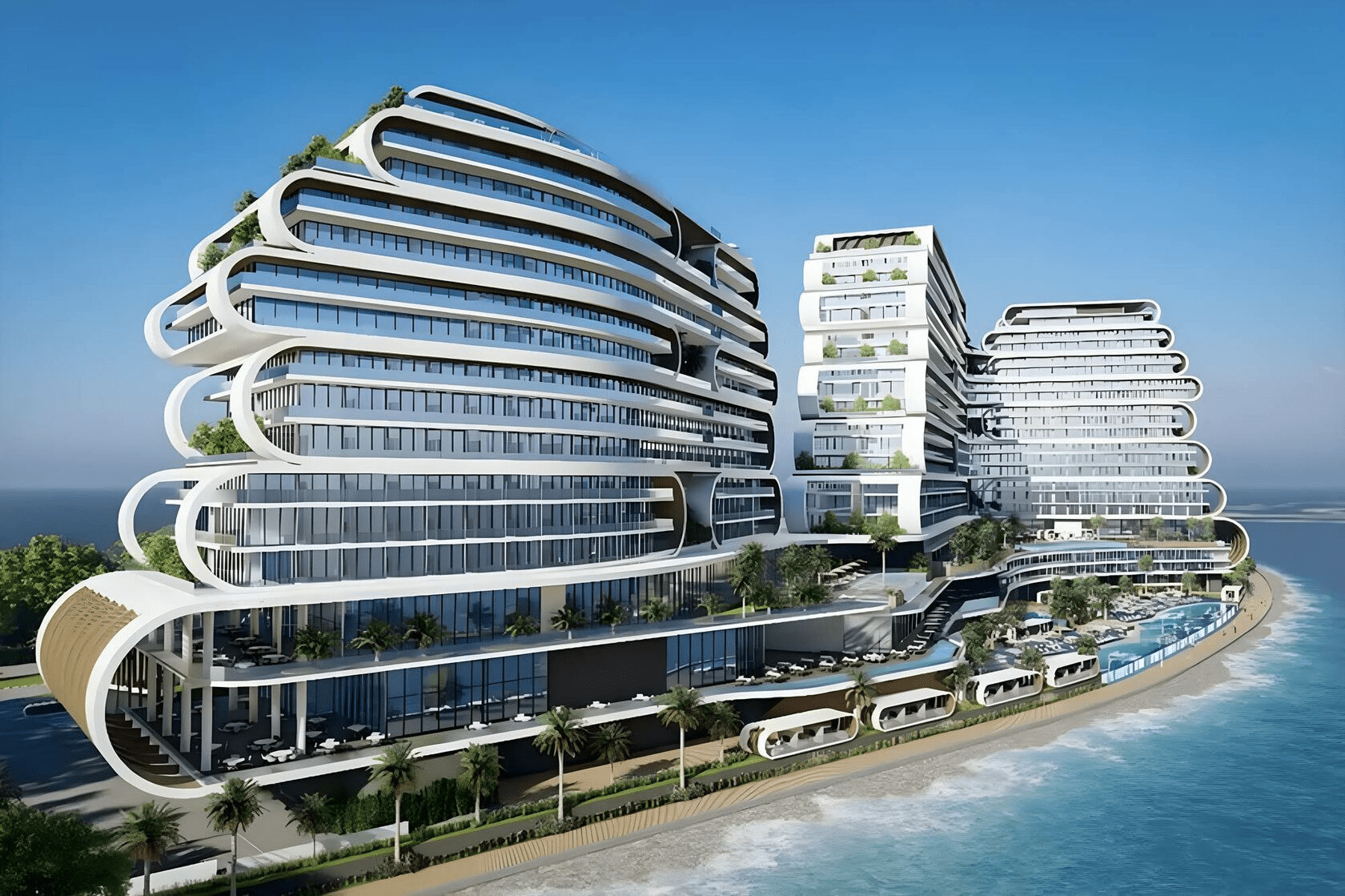

Northern Cyprus is a popular destination for buying real estate among foreign investors, including Russians. The legislation of this country provides for some features of paying VAT when buying real estate.

Unlike most European countries, in Northern Cyprus VAT on the purchase of real estate is only 5%. This is one of the lowest rates in Europe, which makes buying a property here especially attractive.

VAT is paid from the transaction value specified in the purchase and sale agreement. It doesn't matter whether the cost is higher — cadastral or real. This simplifies the tax calculation process and reduces risks for the buyer.

However, it is worth noting that in Northern Cyprus there are restrictions on the purchase of real estate by foreigners. In particular, a foreigner can buy only one property with an area of no more than 1 donum (about 1300 sq. m). To buy more real estate, a government permit is required.

It's also important to know that when selling real estate in North Cyprus from foreigners sales tax is levied, which is 4% of the transaction value. However, this tax is only payable once - on the first sale of the property. No tax is charged on subsequent sales.

Practical aspects of VAT payment in Northern Cyprus

Northern Cyprus is a popular destination for foreigners to buy real estate due to its attractive climate zone, beautiful scenery and developed infrastructure. However, as in any other country, when buying a property here, it is important to take into account tax obligations, including VAT.

In Northern Cyprus, VAT on real estate is 5% of the property price. This tax is charged once upon purchase and must be paid before the property is transferred.

Paying VAT on the cadastral value may be beneficial if it is lower than the market value. This allows you to reduce the tax burden and save on purchases. However, this approach may raise questions from the tax service, especially if the difference between the cadastral and real value is significant.

On the other hand, paying VAT on the actual value may be beneficial if the cadastral value exceeds the market value. In this case, the buyer can save on taxes by paying them from a lower amount. However, this approach requires more careful preparation of documents to confirm the real value of the transaction.

It is important to note that there are a number of VAT benefits for foreign buyers in Northern Cyprus. In particular, when buying the first property, VAT can be reduced or completely canceled. To receive this benefit, you must apply to the tax service with a corresponding application.

When buying a property in Northern Cyprus, it is recommended to contact professional realtors and lawyers who will help you properly complete the transaction and minimize tax payments.

Expert recommendations

As in any other country, when buying a property in Northern Cyprus, it is important to take into account local tax features, including VAT issues.

In Northern Cyprus, as in most countries, VAT is charged on the actual transaction value. However, unlike many other countries, there is no single standard for determining cadastral value, which can create additional difficulties in calculating the tax.

Experts recommend contacting local specialists to get up-to-date information about tax legislation and conduct an independent assessment of the value of real estate. This will help you avoid mistakes and problems with the tax service in the future.

It is also worth remembering that in Northern Cyprus there are various programs for foreign investors that can offer tax benefits and discounts. Therefore, before buying a property here, you should carefully study all available options for optimizing tax payments.

Risks and pitfalls

One of the main risks when paying VAT from the cadastral value is the probability of verification by the tax service. If it is determined that the real value of the transaction was higher, the buyer will have to pay the difference in tax, as well as possible fines and penalties.

On the other hand, when paying VAT from the actual value, it may be difficult to confirm this value before the tax service. In this case, additional documents and references may be required.

Special attention should be paid when buying property abroad, for example, in Northern Cyprus. Despite the fact that this is an attractive area for investment in real estate, the legislation of this region has its own characteristics.

In particular, VAT on real estate in North Cyprus is 5% and is payable on the value stated in the sale contract. However, depending on the terms of the transaction, various discounts and exemptions may apply.

It is important to note that when buying a property in Northern Cyprus, additional costs may arise, such as the transfer tax, which is 3% of the property value, and the annual property tax.

Therefore, before buying a property in Northern Cyprus, it is recommended to consult a local real estate specialist or a lawyer who is familiar with the local legislation.

Northern Cyprus: features of real estate and taxation

When buying property abroad, it is important to take into account the specifics of local legislation. Let's take the example of Northern Cyprus — a popular destination for real estate investors.

Northern Cyprus attracts buyers with its natural beauty, favorable climate and affordable real estate prices. However, when buying a home here, it is worth considering that the tax system in Cyprus is different from the British one.

In particular, VAT on real estate in Northern Cyprus is 5%, and it is paid from the transaction value specified in the purchase and sale agreement. In the UK, the standard VAT rate is 20%, and it is also applied to the transaction value.

In addition, unlike in the UK, Cyprus does not use the concept of cadastral value, so all calculations are made based on the actual transaction price.

It is also important to consider that when purchasing real estate in CyprusYou may need the services of a local lawyer. He or she will help you with all the necessary paperwork and represent your interests when dealing with the local authorities.

In any case, when buying property abroad, it is recommended to carefully study the local legislation and seek professional help. This will help you avoid possible problems and make your purchase as profitable and safe as possible.

Comparison of VAT rates in Northern Cyprus and other European countries

| A country | VAT rate on real estate |

|---|---|

| Northern Cyprus | 5% |

| Germany | 19% |

| France | 20% |

| Spain | 10% |

| Italy | 22% |

| Great Britain | 20% |

As can be seen from the table, the VAT rate on real estate in Northern Cyprus is significantly lower than in most European countries. This makes the purchase of real estate in this region more attractive for investors and those who are looking for an opportunity to move permanently. However, it should be taken into account that each country has its own tax features, which may affect the total purchase price.

In addition to the VAT rate, it is important to take into account other taxes that may be charged when buying a property. For example, in some countries, when buying real estate, a tax is charged on the transfer of ownership rights or registration of a transaction.

You should also keep in mind that different countries may have different conditions for foreign buyers. In some countries, they are subject to higher VAT rates or additional taxes.

In Northern Cyprus, for example, foreign buyers may face additional requirements and restrictions related to the purchase of real estate. However, with the right approach and taking into account all the nuances, buying a property in this region can be a profitable investment.

In any case, before buying a property abroad, it is recommended to consult with a professional realtor or lawyer specializing in real estate and taxation issues in the chosen country. This will help you avoid possible mistakes and unpleasant surprises in the future.

Buying a property is an important and responsible decision that requires a careful approach. One of the most important aspects is the payment of VAT, the amount of which depends on the cadastral and real value of the object. The correct calculation and payment of this tax will help you avoid problems with the law and save on purchases.

- VAT (Value Added Tax) is a tax levied on the purchase price of real estate, amounting to 5% of the transaction value.

- VAT is paid from the transaction value specified in the purchase and sale agreement, regardless of the cadastral or real value.

- A purchase and sale agreement, documents confirming the transaction value, and personal documents of the buyer are required.

- Yes, when buying your first property, benefits may apply, but to do this, you need to contact the tax service.

- A foreigner can buy only one property with an area of no more than 1 donum without special permission from the government.

- In addition to VAT, the buyer may face a transfer of ownership tax (3%) and an annual property tax.

- To purchase a larger property, you need to obtain a special permit from the Government of Northern Cyprus.

- VAT is paid to the tax service before or at the time of transfer of ownership rights, depending on the terms of the transaction.

- The VAT rate is set by law and may change depending on the country's economic policy.

- For up-to-date information and assistance in paying VAT, it is recommended to contact professional realtors and lawyers specializing in real estate in Northern Cyprus.

What is VAT when buying property in Northern Cyprus?

- VAT (Value Added Tax) is a tax levied on the purchase price of real estate, amounting to 5% of the transaction value.

How much VAT is calculated: cadastral or real?

- VAT is paid from the transaction value specified in the purchase and sale agreement, regardless of the cadastral or real value.

What documents are required for VAT payment?

- A purchase and sale agreement, documents confirming the transaction value, and personal documents of the buyer are required.

Can foreigners benefit from VAT benefits in Northern Cyprus?

- Yes, when buying your first property, benefits may apply, but to do this, you need to contact the tax service.

What are the restrictions for foreign buyers in Northern Cyprus?

- A foreigner can buy only one property with an area of no more than 1 donum without special permission from the government.

What additional costs may arise when buying a property?

- In addition to VAT, the buyer may face a transfer of ownership tax (3%) and an annual property tax.

How can a foreigner buy a property larger than the permitted size?

- To purchase a larger property, you need to obtain a special permit from the Government of Northern Cyprus.

What is the procedure for paying VAT when buying a property?

- VAT is paid to the tax service before or at the time of transfer of ownership rights, depending on the terms of the transaction.

Can the VAT rate change in the future?

- The VAT rate is set by law and may change depending on the country's economic policy.

How do I get VAT advice in Northern Cyprus?

- For up-to-date information and assistance in paying VAT, it is recommended to contact professional realtors and lawyers specializing in real estate in Northern Cyprus.