Real Estate Specialist

Southeast Asia (SEA) is a region that attracts the attention of investors from all over the world, and for good reason. Countries such as Thailand, Vietnam and Malaysia have long established themselves in the real estate market, but Cambodia is rapidly coming to the forefront. Its economy has seen impressive growth in recent years and its real estate market is becoming increasingly attractive to foreign investors. In this article, I will help you understand the differences between Cambodia's real estate market and its neighbors so that you can make more informed decisions about your investments.

General overview of the real estate market in SEA

When we're talking about real estate market in Southeast Asiaa few key players come to mind. Cambodia, Thailand, Viet Nam, Laos, Malaysia and Indonesia - are countries that are actively developing their markets, attracting investors from all over the world. Each of these markets has its own characteristics, and it is important to understand what makes them unique. For example, while Thailand is known for its tourist resorts, Cambodia offers more affordable prices and flexible terms for foreign investors. This creates an interesting contrast and many opportunities for analysis and comparison.

Key players and influencing factors

First of all, let's look at the factors that influence the growth of the real estate market in SEA. Economic growth in the region is impressive: according to the data, the GDP of many countries is growing at a 5-7% per year. This creates a steady demand for residential and commercial real estate, which in turn spurs the market. It is also worth noting that tourism is an important driver of the economy. For example, Thailand annually accepts millions of touristsThis makes cities such as Bangkok and Phuket particularly attractive to investors looking to profit from short-term rentals. This makes cities such as Bangkok and Phuket particularly attractive to investors looking to capitalize on short-term rentals.

In addition, foreign investments play a key role in strengthening the real estate market. Countries such as Vietnam and Malaysia are actively working to create favorable conditions for foreign investors by offering various programs and incentives. This makes the region particularly attractive to those looking to invest in real estate. For example, Malaysia has a program "Malaysia is my second home" (MM2H).which simplifies the process of buying real estate for foreign citizens.

Why is the SEA real estate market attracting investors?

So what makes the SEA real estate market so attractive? First of all. affordable prices. For example, prices for Cambodian real estate much lower than in neighboring Thailand or Vietnam. In Phnom Penh, you can buy an apartment from $1,500 per square meterwhile in Bangkok, the cost starts from $3,000 per square meter. This creates a great opportunity for investors who want to maximize the return on their investment.

Secondly, growing middle class in the countries of the region is also contributing to an increase in demand for housing. People are becoming more affluent and starting to look for quality housing, which in turn spurs the market. For example, Phnom Penh, the capital of Cambodia, has seen a strong increase in demand for apartments and condominiums, as evidenced by an increase in new construction projects. This creates excellent opportunities for those who want to buy an apartment in Phnom Penh and generate rental income.

Cambodia: rapid development and unique opportunities

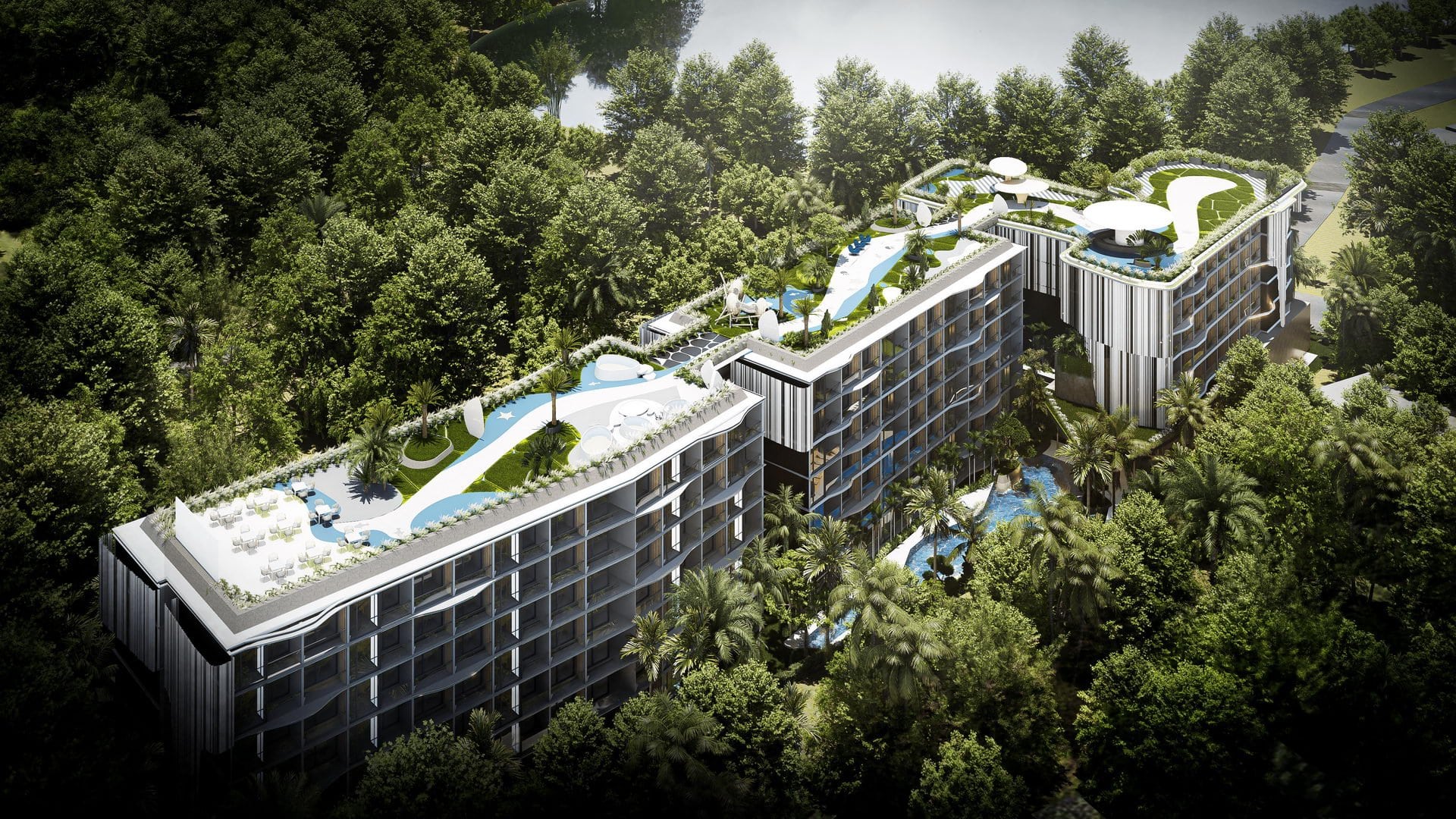

Now let's take a closer look at Cambodia. This country has shown an impressive economic growth rate in recent years, which is approx. 7% per year. It's not just numbers - it's real growth that is being felt at every turn. When I visited Phnom Penh last year, I was amazed at the number of new construction projects that were springing up before my eyes. Attractive condominiums, modern office buildings and even shopping centers - all of this is evidence that the real estate market here is really booming.

One of the key factors that makes Cambodia attractive to investors is the following Loyalty of legislation for foreign citizens. Here there is the possibility of owning an apartment in condominiums, which opens doors for those who want to make real estate investments. Unlike countries with strict restrictions, Cambodia offers more flexible conditions, which is certainly appealing. This allows foreigners to not only invest but also live comfortably in the country, making it particularly attractive for long-term investments.

Real estate prices in Cambodia

Speaking of. real estate pricesIt is worth noting that they remain quite affordable in Cambodia compared to their neighbors. For example, in Phnom Penh you can buy an apartment from $1,500 per square meter. By comparison, in Bangkok, the capital of Thailand, prices start from . $3,000 per square meter. This opens up excellent opportunities for investors looking to buy an apartment in Phnom Penh and get a good rental yield.

In Siem ReapFamous for the splendor of the Angkor temples, villas can be found from $150,000. It is ideal for those who want to not only invest but also enjoy the beauty of this region. Siem Reap is becoming increasingly popular with tourists, which also contributes to the demand for rentals.

Rental yield and risks

As for rental yieldIn Cambodia, it can be as high as 8-12% p.a.. This is quite high compared to other countries in the region, which makes investing in real estate here particularly attractive. However, as in any other business, there are risks involved. Cambodia is still dependent on tourist flowand political instability can affect the market. Therefore, it is important to analyze the situation carefully before making investments.

Now that we've covered the general trends and features of the real estate market in SEA, let's take a closer look at each of the neighboring markets.

Cambodia: real estate market in focus

Features of the real estate market in Cambodia

Cambodia, with its rapidly growing economy and attractive conditions for foreign investors, is becoming an increasingly prominent player in the Southeast Asian real estate market. As I mentioned, GDP growth is about 7% per yearand that's not just a statistic - that's real life that you see on the streets. Phnom Penh and Siem Reap. For example, as I walked around the central districts of Phnom Penh, I was struck by the number of new cafes, restaurants and shopping centers that are opening every day. This one infrastructure boom creates additional opportunities for real estate investment, as rising living standards and consumption drive demand for housing and commercial space.

One of the main reasons foreigners choose Cambodia to buy real estate is. legislative loyalty. Unlike neighboring countries where there are strict restrictions on land ownership, in Cambodia foreigners are free to own condominium apartments. This makes the market more accessible and attractive for investment. Moreover, flexible real estate purchase terms allow investors to feel more confident and secure, which is an important factor when deciding to invest in foreign real estate.

Real estate prices in Cambodia

When it comes to real estate pricesCambodia offers quite favorable conditions. В Phnom Penh apartments start at $1,500 per square meterThis makes them affordable for many investors. For example, if you are looking to buy an apartment in the city center, you can find modern offers that are ideal for renting. This is especially true for young people and expats who want to live in the center of the action. В Siem Reapwhere the famous temples of Angkor are located, villas are available from $150,000. This opens up opportunities for those looking for not only an investment, but also a vacation destination where they can enjoy the unique culture and nature.

In addition, it is worth noting that Cambodia is becoming increasingly popular with tourists, which creates a high demand for rentals. I myself have seen many foreigners choose to rent apartments for long term stays, which makes the rental market even more attractive. This trend can significantly increase the return on investment, especially in tourist areas where the demand for housing is increasing every year.

Rental yield and risks

As for rental yieldIn Cambodia, it can be as high as 8-12% p.a.This is great news for investors looking for ways to generate passive income. This is great news for investors looking for ways to generate passive income. The high rental yields make Cambodia particularly attractive to those who want to not only save their money, but also grow it. However, as with any business, there are risks involved. For example, tourism dependence may affect revenues in the low season, when the flow of tourists decreases.

Political instability can also have an impact on the market, so it is important to closely follow the news and economic situation in the country. Investors should be prepared for possible market fluctuations and factor them into their strategies. Nevertheless, with the right approach and careful analysis, Cambodia can be a great opportunity for a successful real estate investment.

Thailand: a leader with developed opportunities

Now let's compare Cambodia to Thailandwhich has long been a leader in the real estate market in Southeast Asia. This country is known for its developed infrastructure and a high level of tourist flow. Bangkok, the capital of Thailand, attracts millions of tourists every year, which creates a high demand for vacation rentals. Walking the streets of Bangkok, you can notice how tourists fill the local cafes, hotels and shopping centers. However, despite all the advantages, buying real estate for foreigners has its limitations. For example, foreigners can own apartments but not land. This restriction can be an obstacle for those considering larger investments such as buying villas or plots of land.

Real estate prices in Thailand

Prices for real estate in Thailand is significantly higher than in Cambodia. В Bangkok the cost per square meter starts from $3,000and in popular resorts such as. Phuketvillas are priced from $250,000. This makes the market more expensive, but it also opens up opportunities for those looking for prestigious properties. In Phuket, for example, you can find luxury villas with sea views that offer an exceptional level of comfort and privacy.

Rental yield and investment attractiveness

The rental yield here is 6-8% p.a.This is slightly lower than in Cambodia. However, the developed infrastructure and high flow of tourists make Thailand attractive for investors. For example, Bangkok has a steady stream of tenants, both local and foreign, which provides a steady rental income. For investors focused on long-term investments, Thailand offers stability and predictability, which is an important factor in the face of global economic uncertainty.

Prospects and risks

Thailand continues to be an attractive investment destination, but investors should be prepared for some risks. For example, market saturation may lead to lower rental prices in some areas, especially during periods of low tourist season. In addition, legal restrictions for foreign investors can complicate the process of buying real estate. Nevertheless, with the right approach and careful analysis, Thailand can be a lucrative destination for those looking for a stable investment in a dynamic region.

To summarize, Thailand, despite higher prices and some restrictions for foreign investors, offers unique opportunities due to its developed infrastructure and high tourist flow. This makes it attractive for those looking for a stable and prestigious real estate investment. It is important to carefully analyze the market and consider all risks in order to maximize the potential of this unique destination.

Vietnam: a fast-growing market with constraints

Rapid growth and potential

Vietnam is a country that in recent years has demonstrated a impressive economic growth and significant changes in the real estate sector. Every year more and more investors pay attention to this market, due to its great potential. For example, in Hanoi real estate prices start at $2,000 per square meterwhich makes it accessible to new investors. В Ho Chi Minh City the cost per square meter reaches $3,500This is due to the high demand for housing in this dynamic city.

Restrictions for foreign investors

However, despite all the advantages, Vietnam has its own restrictions on foreign investors. For example, they may lease land only for a term of up to . 50 years. This can cause concern for those who are planning long-term investments and want to be sure of their ownership for a longer period of time. Such restrictions require investors to plan and analyze the market more carefully before buying.

Rental yield and risks

Nevertheless, rental yield in Vietnam reaches 7-9% p.a.This makes it attractive for investors seeking a stable income. This is especially true in large cities, where the demand for rental housing remains high. However, it is worth considering bureaucratic complexitywhich can make it difficult to process transactions, and possible overproduction in the market, which could lead to lower real estate prices.

Attractiveness to investors

Despite the existing restrictions, Vietnam remains an interesting option for investors due to its economic growth and developing infrastructure. For example, the government is actively investing in developing the transportation network and improving urban infrastructure, making cities more attractive for living and business. These changes are driving up demand for real estate and creating new opportunities for investors looking for long-term prospects.

Vietnam offers unique opportunities for real estate investment, combining affordable prices, high rental yield and dynamic infrastructure development. However, potential investors should consider the existing restrictions and risks associated with bureaucracy and possible overproduction. With the right approach and careful analysis, Vietnam's real estate market can be a profitable investment for those seeking new horizons in Southeast Asia.

Malaysia: stability and programs for foreigners

Economic stability and high standard of living

Malaysia offers investors not only stable economybut also high standard of livingThe country is known for its multicultural environment, developed infrastructure and favorable business climate. The country is known for its multicultural environment, developed infrastructure and favorable climate for business. This creates an attractive living and working environment, which in turn supports the demand for real estate.

Malaysia My Second Home (MM2H) Program

One of the key factors attracting foreign investors is the program of "Malaysia is my second home" (MM2H).. This initiative simplifies the process of buying real estate for foreigners, allowing them to obtain long-term visas and enjoy a number of benefits. Through this program, Malaysia becomes more accessible to those who want to not only invest but also settle in the country for the long term.

Real estate prices

In Kuala Lumpur real estate prices start at $2,000 per square meterThis makes the city accessible to a wide range of investors. В PenangFamous for its beaches and cultural heritage, villas range in price from $400,000. This opens up opportunities for those looking for not only an investment but also a comfortable place to live. Penang is particularly popular with expats due to its unique blend of nature and urban environment.

Rental yields and investment prospects

Rental yield in Malaysia is 5-7% p.a.This may seem less attractive compared to other countries in the region. However, the stability of the economy and high standard of living make up for this difference, offering investors confidence in their investments. Developed infrastructure and stable rental demand make Malaysia a good option for those looking for a reliable investment with minimal risks.

Stability and diversity

Malaysia offers stability and diversityThis makes it attractive to investors looking for long-term prospects. The diversity of cultures and high standard of living make the country an attractive place to live, which in turn supports the demand for real estate. Investors can expect stable returns and confidence in the future, making Malaysia a good investment option.

Indonesia: constraints and opportunities

Picturesque islands and rich culture

Indonesia - is a country that beckons with its picturesque islands and rich cultureIt is a popular tourist destination, attracting the attention of investors from all over the world. Every year, millions of tourists visit such popular destinations as Bali and JakartaThis creates a high demand for rental housing. However, for successful investment in Indonesian real estate, it is necessary to take into account a number of peculiarities and limitations characteristic of this market.

Restrictions on real estate ownership

One of the main features of the real estate market in Indonesia are. strict restrictions on the ownership of real estate by foreigners. Unlike other countries in the region, foreigners here have access only to . long-term lease. This can be a serious obstacle for those who want to invest in property and expect to make long-term investments. Potential investors should carefully review the legislation and possible options for owning real estate through local partners or companies.

Real estate prices

Prices for Indonesian real estate vary from region to region. For example, in Baliwhich is one of the most popular tourist destinations, villas can be found from $200,000.. This makes the island attractive to those looking for a short-term investment and want to generate rental income. В Jakartathe capital of Indonesia, the price per square meter starts at $1,500.This makes the city accessible to a wide range of investors.

Rental yields and investment prospects

Despite the current limitations, Rental yields in Bali can be as high as 10% per annumThis makes it an attractive market for short-term investments. The high demand for rentals among tourists and expats provides a steady income, especially during peak seasons. However, as is the case with Cambodia, the market is subject to the following seasonal variations and legal complexitieswhich requires investors to carefully analyze and prepare.

Indonesia offers unique real estate investment opportunities, especially in popular tourist destinations. Despite restrictions on foreign investorsThe country remains attractive due to its cultural richness and natural beauty. Successful Indonesian real estate investments require consideration of all legal aspects and careful planning. With the right approach, Indonesia can be a lucrative destination for short and medium term real estate investments.

Comparative table

To better understand the differences between the real estate markets in Southeast Asian countries, I have prepared a brief table that summarizes the results:

| A country | Real estate prices (from) | Rental yield | Risks | Ease for foreigners | Economic growth | Tourist flow | Infrastructure |

|---|---|---|---|---|---|---|---|

| Cambodia | $1,500 per m² (Phnom Penh) | 8-12% | Dependence on tourism, political instability | High | High (7% GDP) | Moderate | Developing |

| Thailand | $3,000 per m² (Bangkok) | 6-8% | Market saturation, competition | Average | Average | Tall | Developed |

| Vietnam | $2,000 per m² (Hanoi) | 7-9% | Complexity of bureaucracy, overproduction | Low | Tall | Moderate | Developing |

| Malaysia | $2,000 per m² (Kuala Lumpur) | 5-7% | Saturation of the premium segment | High | Average | Tall | Developed |

| Indonesia | $1,500 per m² (Jakarta) | 10% in Bali | Legal complexities, seasonality of tourism | Low | Average | High in Bali | Developing |

Key points

- Cambodia stands out due to its affordable prices and high rental yields, but investors should consider the dependence on tourism and political instability.

- Thailand offers developed infrastructure and high tourist flow, but faces market saturation and competition.

- Vietnam attracted by rapid economic growth, but the complexity of the bureaucracy and restrictions on foreigners can be an obstacle.

- Malaysia offers stability and high ease for foreigners, but the premium market may be saturated.

- Indonesia is attractive for short-term investments in Bali, but legal complexities and the seasonality of tourism require careful planning.

Key recommendations for investors

If you are considering investing in real estate in SEA, here are a few key points to consider:

- Study the market: Before making a decision, be sure to familiarize yourself with the current trends in the real estate market in your chosen country. Each market is unique and it is important to understand its particularities.

- Assess the risks: Be aware of potential risks. Political instability, economic changes and seasonal fluctuations may affect your investment.

- Check the legislation: Make sure you understand all the legal aspects of buying real estate in your chosen country. This is especially important in countries with restrictions for foreign investors.

- Consultations with experts: Work with local agents and lawyers to get expert help when buying real estate. This will help avoid problems and make the process smoother.

- Cambodia as a starting point: If you are new to investing in SEA, Cambodia can be a great place to start. Here you will find affordable prices, high rental yields and the opportunity to own real estate.

Conclusions

We've looked at the real estate markets in Cambodia, Thailand, Vietnam, Malaysia and Indonesia, and now we can draw a few key conclusions. Cambodia stands out from its neighbors due to its affordable real estate and high rental yields. This makes it attractive to investors, especially those looking for opportunities in emerging markets.

If you are considering investing in SEA, start with Cambodia. It is a country with great potential and unique opportunities. Don't miss the chance to make the right choice and maximize the return on your investment!

If you still have questions or would like advice on real estate investment in Cambodia, don't hesitate to contact us. We are here to help you every step of the way on your journey to a successful investment!

Cambodia offers affordable real estate prices and high rental yields up to 12%, as well as loyal conditions for foreign investors.

In Thailand, foreigners can own apartments but not land, which can limit long-term investment opportunities.

Key risks include bureaucratic complexity, overproduction, and restrictions on land leases to foreigners for up to 50 years.

Malaysia offers a stable economy, high ease for foreigners due to the MM2H program and a variety of investment opportunities.

Indonesia has strict restrictions on property ownership for foreigners, but offers high rental yields in Bali of up to 10%.

Rental yields vary: Cambodia (8-12%), Thailand (6-8%), Vietnam (7-9%), Malaysia (5-7%), Indonesia (up to 10% in Bali).

Factors include real estate prices, rental yields, economic stability, infrastructure and ease for foreign investors.

Cambodia offers lower real estate prices, flexible terms for foreign investors and high rental yields, making it an attractive investment.

Thailand's high tourist flow keeps rental demand stable, especially in tourist areas such as Phuket and Bangkok, which contributes to investment returns.

The growth prospects for the real estate market in Indonesia are linked to the development of tourism, especially on the island of Bali, and improved infrastructure, which may increase attractiveness to investors.

Why is Cambodia considered attractive for real estate investment?

Cambodia offers affordable real estate prices and high rental yields up to 12%, as well as loyal conditions for foreign investors.

What are the restrictions for foreign investors in Thailand?

In Thailand, foreigners can own apartments but not land, which can limit long-term investment opportunities.

What are the main risks when investing in Vietnam real estate?

Key risks include bureaucratic complexity, overproduction, and restrictions on land leases to foreigners for up to 50 years.

What makes Malaysia attractive to foreign investors?

Malaysia offers a stable economy, high ease for foreigners due to the MM2H program and a variety of investment opportunities.

What features of Indonesia's real estate market are worth considering?

Indonesia has strict restrictions on property ownership for foreigners, but offers high rental yields in Bali of up to 10%.

How do you compare rental yields in SEA countries?

Rental yields vary: Cambodia (8-12%), Thailand (6-8%), Vietnam (7-9%), Malaysia (5-7%), Indonesia (up to 10% in Bali).

What factors influence the choice of country for investment in SEA?

Factors include real estate prices, rental yields, economic stability, infrastructure and ease for foreign investors.

What advantages does Cambodia's real estate market offer compared to neighboring countries?

Cambodia offers lower real estate prices, flexible terms for foreign investors and high rental yields, making it an attractive investment.

How does the tourist flow affect the real estate market in Thailand?

Thailand's high tourist flow keeps rental demand stable, especially in tourist areas such as Phuket and Bangkok, which contributes to investment returns.

What are the growth prospects for the real estate market in Indonesia?

The growth prospects for the real estate market in Indonesia are linked to the development of tourism, especially on the island of Bali, and improved infrastructure, which may increase attractiveness to investors.