Real Estate Specialist

The question of where it is more profitable to buy real estate - in Bangkok or Pattaya - is becoming more and more relevant for investors. Thailand attracts attention not only for its natural beauty and culture, but also for its investment opportunities. Let's look at why these two cities have become a center of attraction for investors.

A brief overview of the real estate market

Bangkok offers a wide range of premium real estate. The average price per square meter here is about 3,000-4,500 euros. The city attracts professionals looking for house rental in Bangkok, creating a high demand for apartments.

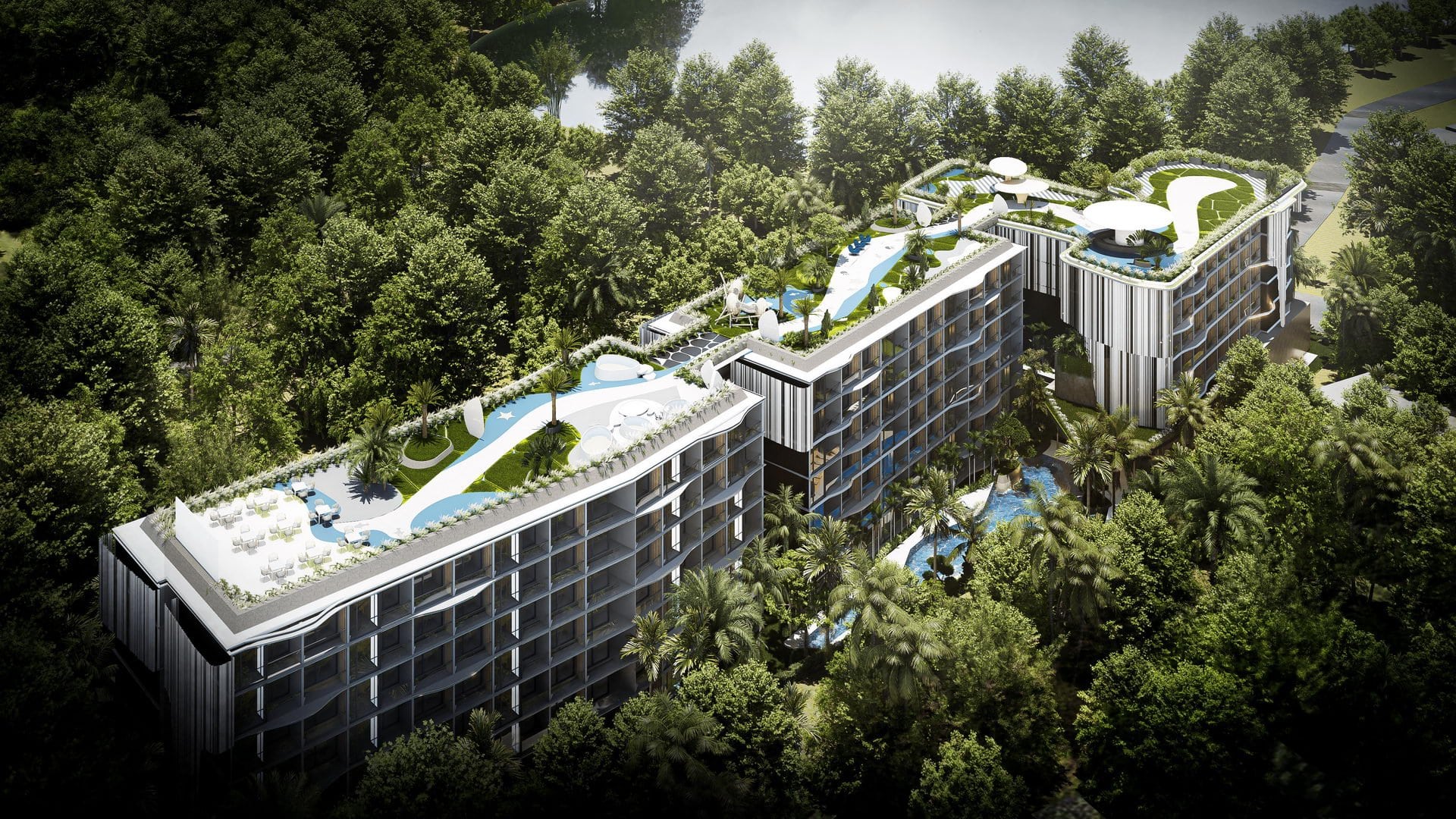

In Pattaya The market is oriented towards tourists and foreign investors. Attractive condominiums can be found here at prices from 2,000 to 3,500 euros per square meter. This resort area is known for its vibrancy and ability to generate income from short-term rentals.

Real estate market analysis in Bangkok and Pattaya

Bangkok: premium housing market

Bangkok is a true metropolis where. real estate is not only diverse, but also promising for investment. If you are looking for premium housingthere's an incredible selection to choose from. Prices for luxury apartments can range from 4,000 to 6,000 euros per square meterdepending on the neighborhood and infrastructure.

Commercial real estate is also gaining momentum. Business centers and office space attract a lot of companies, which makes the investment in Thailand particularly attractive. Demand for Bangkok vacation rentals among working professionals is consistently high, which allows you to count on a stable income.

Pattaya: resort real estate market

Pattaya is a place where holiday property is breaking all records in terms of popularity. Thanks to the constant flow of tourists, investors see excellent investment opportunities here. Kondo in Pattaya can be purchased at prices from 2,000 to 3,500 euros per square meter. This city is known for its affordability and attractiveness to foreign buyers.

Tourists and expats often opt for Pattaya vacation rentalsThis makes short-term rentals particularly lucrative. As a result, the market remains dynamic and attractive to investors.

Price dynamics, trends and forecasts

In recent years real estate prices in both cities show steady growth. Bangkok is expected to see an increase in demand for premium facilitieswhich may lead to a price increase of 5-7% in the coming years. In Pattaya, due to the development of tourist infrastructure, prices are forecasted to increase by 5-7% in the coming years. holiday property on 4-6%.

Trends show that both locations continue to grow, offering investors unique profit opportunities. Wondering which you will choose? After all, each city offers its own advantages!

Comparison of key investment drivers in Bangkok and Pattaya

Below is a comparative table of the key factors for investing in real estate in Bangkok and Pattaya. All figures are estimates and may vary depending on the specific property and market conditions.

| Indicator | Bangkok | Pattaya |

|---|---|---|

| Price per 1 sq.m. on average | 3,500-5,500 euros. | 2,000-3,500 euros. |

| Formalization | Foreigners may purchase condominium units on a freehold basis. | Foreigners may purchase condominium units on a freehold basis. |

| Tax on the purchase of real estate | Approximately 6.3% of the value of the property including transfer tax, stamp duty and withholding tax. | Approximately 6.3% of the value of the property including transfer tax, stamp duty and withholding tax. |

| Real estate ownership tax, per year | For properties worth up to 10 million baht (~260,000 euros), no tax is charged if the owner is registered at that address. | For properties worth up to 10 million baht (~260,000 euros), no tax is charged if the owner is registered at that address. |

| Payback | 4-6% per annum for long-term leases. | Up to 8% per annum for short-term rentals during the tourist season. |

| Rent per day, average | 50-100 euros. | 40-80 euros. |

| Profit per year, on average | 4,000-6,000 euros on a long term lease. | 5,000-7,000 euros for short-term rentals during the tourist season. |

| Annual growth of tourists | About 5%. | About 10%. |

| Real estate price growth per year | 3-5%. | 2-4%. |

The choice between Bangkok and Pattaya depends on your goals. Bangkok Suitable for those who are looking for stability and are willing to invest in a premium facilities. Pattaya - for those who want to make money short-term lease and resort real estate. The choice is yours!

Nuances when buying a home in Thailand

Bangkok: condominiums vs private homes

In Bangkok purchase condominiums - the most popular option for foreign investors. This is due to the fact that foreigners are allowed to own up to 49% of the total number of apartments in a single building. The average cost of a condo is 3,000-5,000 euros per square meter.

Private homes in Bangkok is a less affordable option for foreigners as land ownership is limited. However, it is possible to rent land on a long-term basis, which can be a way out for those who want to own their own home.

Pattaya: investment in tourist areas

Pattaya Offers many opportunities to invest in tourist areas. Resort real estate is in demand here, especially among foreign buyers. Kondo in popular neighborhoods can be purchased at prices from 2,000 to 3,500 euros per square meter.

However, it is important to consider legal difficulties. For example, you need to carefully check documents and comply with all legal requirements to avoid problems in the future.

Purchase process and required documents

process buying an apartment in Thailand requires attention to detail. Key documents include:

- Sale and Purchase Agreement

- Bank certificate of transfer of funds to Thailand

- Registration of ownership rights with the land department

The process can take anywhere from a few weeks to a few months, depending on the complexity of the transaction. Legal aspects of buying a home in Thailand require careful consideration and it is best to seek the assistance of local lawyers.

Buying real estate in Thailand is a chance for investors to gain access to one of the fastest growing markets. Bangkok offers stability and diversity, and Pattaya - opportunity to capitalize on resort real estate. The main thing is to be careful and thorough in every transaction.

Similarities and features of the real estate market in Bangkok and Pattaya

Common features

Both cities are attracting significant attention from foreign investors. Legal regulation Thailand allows foreigners to own real estate in condominiums, making this an affordable and attractive market. Investing in Thailand remain popular due to a stable economy and favorable business environment.

Differences in infrastructure

Bangkok - is a metropolis with a developed infrastructure. Here you will find extensive public transportation networkincluding subways and buses. This makes the city convenient for living and working. Real estate in Bangkok are often chosen by those who value comfort and affordability.

Pattayaon the contrary, it's tourism-oriented. There is no subway, and personal transportation plays a key role. However accessibility of beaches and resort areas makes the city attractive for vacations and short-term stays.

Audience of tenants

In Bangkok the main tenants are expats and working professionals. This creates a stable demand for Bangkok vacation rentals. Pattaya It also attracts tourists and temporary residents, making the rental market more seasonal, but also more profitable during peak periods.

Level of competition

Competition in Bangkok higher due to the large number of offers and developed infrastructure. Pattaya offers more niche opportunities, especially in tourist areas where competition is lower but demand for holiday property remains high.

Bangkok and Pattaya - are two different worlds, each offering unique investment opportunities. Bangkok suitable for those looking for stability and developed infrastructure, while the Pattaya - the perfect choice for those who want to make money on resort real estate and enjoy a more relaxed lifestyle. The choice depends on your goals and preferences.GoodBad

Prospects for growth and development of resort real estate

Bangkok: the impact of business activity

Bangkok continues to develop as a key business center of the region. Business activity stimulates the growth of new neighborhoods such as Rama IX and Thonburi, where active construction is underway. premium residential complexes and office buildings. Investing in Thailand in these areas can become especially profitable, as real estate prices here are still at the level of 3,500-5,500 euros per square meterbut is projected to grow in the coming years.

Pattaya: the role of tourism

Pattaya remains a magnet for tourists from all over the world, which keeps demand high for holiday property. The city is actively developing new resort areas such as Jomtien and Na Klua, where modern complexes with a full range of amenities are being built. Average cost here is 2,500-4,000 euros per square meter.

Large investment projects, such as the construction of new shopping centers and entertainment complexes, strengthen the appeal of the Pattaya for investors. Tourism remains the main driver of the economy, and this creates favorable conditions for the growth of real estate prices.

New resort areas

In Pattaya development of new resort areas continues, which opens up additional investment opportunities. Projects to improve infrastructure and create new tourist routes make the city more and more attractive for vacationers and investors.

Bangkok and Pattaya offer excellent prospects for growth and development resort real estate. If you are looking for a stable investment in a business center, Bangkok - your choice. If, however, you want to invest in an emerging tourist market, Pattaya will provide many income opportunities. The choice is yours!

Yield from short-term and long-term leases

Bangkok: stable rental market

Bangkok - is a town where rental accommodation is in steady demand. Expats and office workers create a constant demand for long-term lease. Profitability of such investments is approximately 4-6% p.a.. Due to the developed infrastructure and business activity, the rental market here remains stable.

Pattaya: high seasonality

In Pattaya yield from short-term rental can be significantly higher, especially during the tourist season. Resort real estate here is in demand among tourists, which allows you to get up to 8% p.a.. However, it is important to consider seasonality: during the low season, revenues may drop, but overall the market remains profitable.

Which type of lease is more profitable?

The choice between short-term and long-term rentals depends on your goals and preferences. Bangkok offers stability and predictability, which is suitable for those looking for reliable investments. PattayaWith its high seasonal yield potential, it attracts those who are willing to take risks for higher returns.

Both cities offer unique opportunities for investment in Thailand. Bangkok is suitable for those who value stability and long-term prospects, while the Pattaya is offering a chance to make money on resort real estate and short-term leases. The choice depends on your investment objectives and risk appetite.

Economy and life in Bangkok and Pattaya

Bangkok: a megacity with a developed economy

Bangkok - is not only the capital but also the economic center of Thailand. The city offers a huge variety of jobs in industries such as finance, technology and commerce. Many international companies are headquartered here, attracting skilled professionals from all over the world. This, in turn, creates a steady demand for Bangkok vacation rentals.

In addition, investment in Thailand through buying real estate in Bangkok is often seen as a reliable way to preserve capital. The city continues to develop, and new projects such as infrastructure improvements and the construction of modern residential complexes make it even more attractive to investors.

Pattaya: tourism-oriented

Pattaya is known as one of Thailand's major tourist centers. The city offers a variety of entertainment and resort areas, making it popular among tourists and temporary residents. Resort Thai real estate Pattaya is often an investment destination due to high demand during the tourist season.

Seasonality notwithstanding, Pattaya real estate remains attractive due to the constant development of the tourist infrastructure. New hotels, restaurants and entertainment complexes continue to appear, which contributes to the growth of the economy and makes the city interesting for investors looking for an opportunity to earn money on short-term rentals.

Education and medicine

Bangkok: prestigious international schools and quality clinics

Bangkok Offers a wide range of prestigious international schools such as Bangkok Patana School and International School Bangkok. These institutions provide high quality education and attract families from all over the world. Tuition at these schools costs about 10,000-20,000 euros per yearbut it's an investment in your children's future.

Medical services in Bangkok are also of a high standard. Famous private clinics are located here, such as Bumrungrad International HospitalThe cost of medical services can vary, but the quality and affordability make Bangkok attractive to expats and investors. The cost of medical services can vary, but the quality and affordability make Bangkok attractive to expats and investors.

Pattaya: limited choice of educational institutions and travel health services

Pattaya offers a less wide range of educational institutions compared to Bangkok. However, there are several international schools here, such as Regents International School Pattayawhich provide a decent education. The cost of education is approx. 8,000-15,000 euros per year.

Medical services in Pattaya are mainly tourist-oriented. The city offers a number of clinics specializing in travel medicine, which can be convenient for short-term residents. However, for more sophisticated medical services, many people prefer to go to Bangkok. Overall, Pattaya real estate remains attractive to those who value affordability and comfort combined with a resort lifestyle.

Roads and transportation

Bangkok: developed metro network and transportation challenges

Bangkok has one of the most developed transportation systems in Southeast Asia. Subway (BTS and MRT) covers key areas of the city, providing convenient transportation for residents and tourists. The metro fare is approx. 1-2 eurosmaking it an affordable and popular mode of transportation.

However, despite a well-developed public transportation network, plugs remain a serious problem in Bangkok. During peak hours, roads can be congested, making traveling by car less convenient. Nevertheless, cabs and motorcycle cabs are always available and remain a popular option for getting around the city quickly.

Pattaya: dependence on personal transportation

In Pattaya There is no subway, and residents are largely dependent on the personal transportation. Rent a car or motorcycle - common practice for tourists and residents, allowing freedom of movement in and around the city. The cost of renting a motorcycle is approx. 5-10 euros a daywhich makes it an affordable option.

Availability beaches and resort areas in Pattaya makes the city attractive for those who appreciate the opportunity to get to the sea quickly. However, the lack of a well-developed public transportation network can be a limitation for those accustomed to the conveniences of a metropolis. Real estate in Pattaya remains popular due to its proximity to major tourist attractions and resort areas.

Legal and tax specifics

Bangkok: complex tax nuances

Bangkok offers many investment opportunities, but it is important to consider property taxes in Thailand. There are specific tax obligations for commercial and residential real estate investors. For example, tax on the purchase of real estate can be approx. 2-3% of the cost of the facility. There are also annual property taxes that depend on the type and value of the property.

Legal aspects can be complicated, especially for foreign investors. It is recommended to cooperate with local lawyers to avoid problems and to get all documents correct. Buying an apartment in Thailand requires careful consideration of all the legal nuances.

Pattaya: simplified taxation system

Pattaya offers a simpler tax system, especially for those planning to rent out. Taxes on rental income generally amount to approx. 5-10%This makes this type of investment more attractive.

Features of ownership condo in Pattaya are also simplifying the process for foreign buyers. Foreigners can own up to 49% of the total number of apartments in a single building, making the investment in Thailand more affordable. Nevertheless, it is important to carefully study all legal aspects and consult with professionals to avoid possible difficulties.

What should an investor choose: Bangkok or Pattaya?

Who's right for Bangkok?

Bangkok - an ideal choice for those looking for stable and long-term investments. The city offers premium real estate with high liquidity and stable demand for Bangkok vacation rentals. The average cost per square meter in prestigious areas is about 4,000-6,000 eurosThis makes it attractive to investors willing to invest in safe assets.

If you are looking for business opportunities, Bangkok with its developed economy and infrastructure will be your ideal partner. From business centers to international schools for your children, you will find everything you need to do business successfully here.

Who's Pattaya for?

Pattaya attracts investors who want to capitalize on short-term lease and resort real estate. The city offers more affordable options, with condominium prices from . 2,000 to 3,500 euros per square meter. High seasonality allows for significant revenues during the tourist season, making such investments particularly lucrative.

If you appreciate a more relaxed lifestyle and want to enjoy the sea and beaches, Pattaya will be the perfect choice for you. Here you can not only invest but also enjoy life in one of the most popular resorts in Thailand.

The choice between Bangkok and Pattaya depends on your goals and preferences. Bangkok offers stability and well-developed infrastructure, while the Pattaya - opportunity to capitalize on resort real estate and enjoy a more relaxed lifestyle. Regardless of your choice, investment in Thailand promise to be profitable and promising.

Bangkok attracts investors with its developed infrastructure, stable real estate market and business opportunities. The city offers premium housing and high rental demand, making it attractive for long-term investments.

Pattaya is popular for its resort areas and high short-term rental income. The city attracts tourists from all over the world, which creates a steady demand for rental properties.

The main risk in Pattaya is seasonality. Rental income can fluctuate significantly depending on the tourist flow. However, continuous infrastructure development helps to minimize these risks.

The average cost per square meter in Bangkok's prestigious areas is around 4,000-6,000 euros. This makes the city attractive to investors looking for premium real estate.

To buy a property in Thailand, you need a sales contract, a bank certificate of transfer of funds into the country and registration of title with the land department.

Bangkok offers advanced infrastructure, access to international schools and quality medical services. This makes it an ideal location for families and professionals.

Pattaya is actively developing new resort areas, building hotels and entertainment complexes. This contributes to the growth of tourist flow and makes the city attractive to investors.

Property taxes in Thailand include purchase tax, which is about 2-3% of the value, and annual taxes depending on the type and value of the property.

Pattaya condominiums offer affordable prices and high income from short term rentals. It is an excellent choice for those who want to invest in resort real estate.

The choice depends on your goals: Bangkok offers stability and business opportunities, while Pattaya offers high incomes from resort real estate and a more relaxed lifestyle.

What attracts investors to Bangkok?

Bangkok attracts investors with its developed infrastructure, stable real estate market and business opportunities. The city offers premium housing and high rental demand, making it attractive for long-term investments.

Why is Pattaya popular among real estate buyers?

Pattaya is popular for its resort areas and high short-term rental income. The city attracts tourists from all over the world, which creates a steady demand for rental properties.

What are the risks associated with investing in Pattaya?

The main risk in Pattaya is seasonality. Rental income can fluctuate significantly depending on the tourist flow. However, continuous infrastructure development helps to minimize these risks.

What is the average cost per square meter in Bangkok?

The average cost per square meter in Bangkok's prestigious areas is around 4,000-6,000 euros. This makes the city attractive to investors looking for premium real estate.

What documents are required to purchase a property in Thailand?

To buy a property in Thailand, you need a sales contract, a bank certificate of transfer of funds into the country and registration of title with the land department.

What are the advantages of living in Bangkok?

Bangkok offers advanced infrastructure, access to international schools and quality medical services. This makes it an ideal location for families and professionals.

How is Pattaya developing its tourism infrastructure?

Pattaya is actively developing new resort areas, building hotels and entertainment complexes. This contributes to the growth of tourist flow and makes the city attractive to investors.

What taxes apply to real estate in Thailand?

Property taxes in Thailand include purchase tax, which is about 2-3% of the value, and annual taxes depending on the type and value of the property.

Why should you consider buying a condominium in Pattaya?

Pattaya condominiums offer affordable prices and high income from short term rentals. It is an excellent choice for those who want to invest in resort real estate.

How to choose between Bangkok and Pattaya for investment?

The choice depends on your goals: Bangkok offers stability and business opportunities, while Pattaya offers high incomes from resort real estate and a more relaxed lifestyle.