Cambodia real estate investment prospects: why now is the time?

Real Estate Specialist

Cambodia is a country that attracts the attention of investors from all over the world. Every year it becomes more and more attractive for real estate investments, and for good reason. The country demonstrates steady economic growth, develops its infrastructure and offers favorable conditions for foreign investors. If you have ever thought about investing in real estate, now is the perfect time to look at Cambodia.

Economic situation and growth of the real estate market

Cambodia has in recent years been experiencing real economic boom. According to the World Bank, in 2023, the country's GDP growth was about 5.5%. This is an impressive figure, especially when it comes to developing countries. Such stable economic growth creates an excellent environment for real estate investment. Cambodia's real estate market in 2024 expects continued prosperityand it's not just a prediction, it's a reality.

Real estate in Cambodia is becoming increasingly attractive to investors due to the growing demand for housing and commercial space. For example, in Phnom Penhhe capital of the country is witnessing an active construction of new residential complexes and office buildings. This year housing prices in the capital rose by 7%This is a testament to the growing interest from buyers. If you are thinking about buying real estate, now is the time to prices haven't had time to skyrocket yet..

In particular, it is worth paying attention to neighborhoods that are actively developing. For example, SihanoukvilleKnown for its beaches, it has become a real magnet for tourists and investors. Every year the number of tourists is increasingThis creates a high demand for resort Cambodian real estate. В 2024 is expected to bethat the number of international tourists will reach 5 millionthat on 15% morethan in 2023. This opens up new horizons for investors wishing to earn money from rental real estate.

However, despite the positive trends, it is important not to forget about possible risks. For example, economic situation may changeand it will affect the real estate market. So it's important to analyze the data carefully and keep an eye on trends in the economy. But if you're up for the challenge, Cambodia can be your golden ticket to the world of investment.

Types of real estate for investment

When it comes to real estate in Cambodia, huge choice. There are several popular categories that attract the attention of investors. Let's take a closer look at each of the types of real estate that can become profitable investments.

Apartments and residential complexes

Apartments and residential complexes - are the most common objects for buying and renting. Many foreigners prefer to invest in housing as it is always in demand. In Phnom Penh, for example, the average cost of an apartment is from 1,500 to 3,000 dollars per square meter.

Investors can expect rental yields in the range of 6-8% per year. This makes apartments attractive to those looking for a stable income. In addition, with a growing population and an increasing number of expats, the demand for housing continues to rise.

Commercial real estate

Commercial real estate is also finding its buyers. Offices, shopping centers and hotels are becoming increasingly popular with investors. Phnom Penh has seen a growing interest in office space as more international companies open offices in the country.

The average cost of office space in Phnom Penh ranges from 1,000 to 2,500 dollars per square meter. Investors can expect yields on office leases in the range of 7-10% per year. This makes commercial real estate attractive to those looking to invest in stable assets.

Land plots

Land plots - is another interesting category for investment. With the growing demand for residential and commercial real estate, buying land in Cambodia can be a lucrative investment. For example, the cost of a plot of land can range from $25 to $100 per square meterdepending on location.

You can consider building residential complexes or shopping centers, which will provide you with a stable income in the future. Investing in land also allows you to avoid some of the risks associated with existing real estate.

Villas and luxury real estate

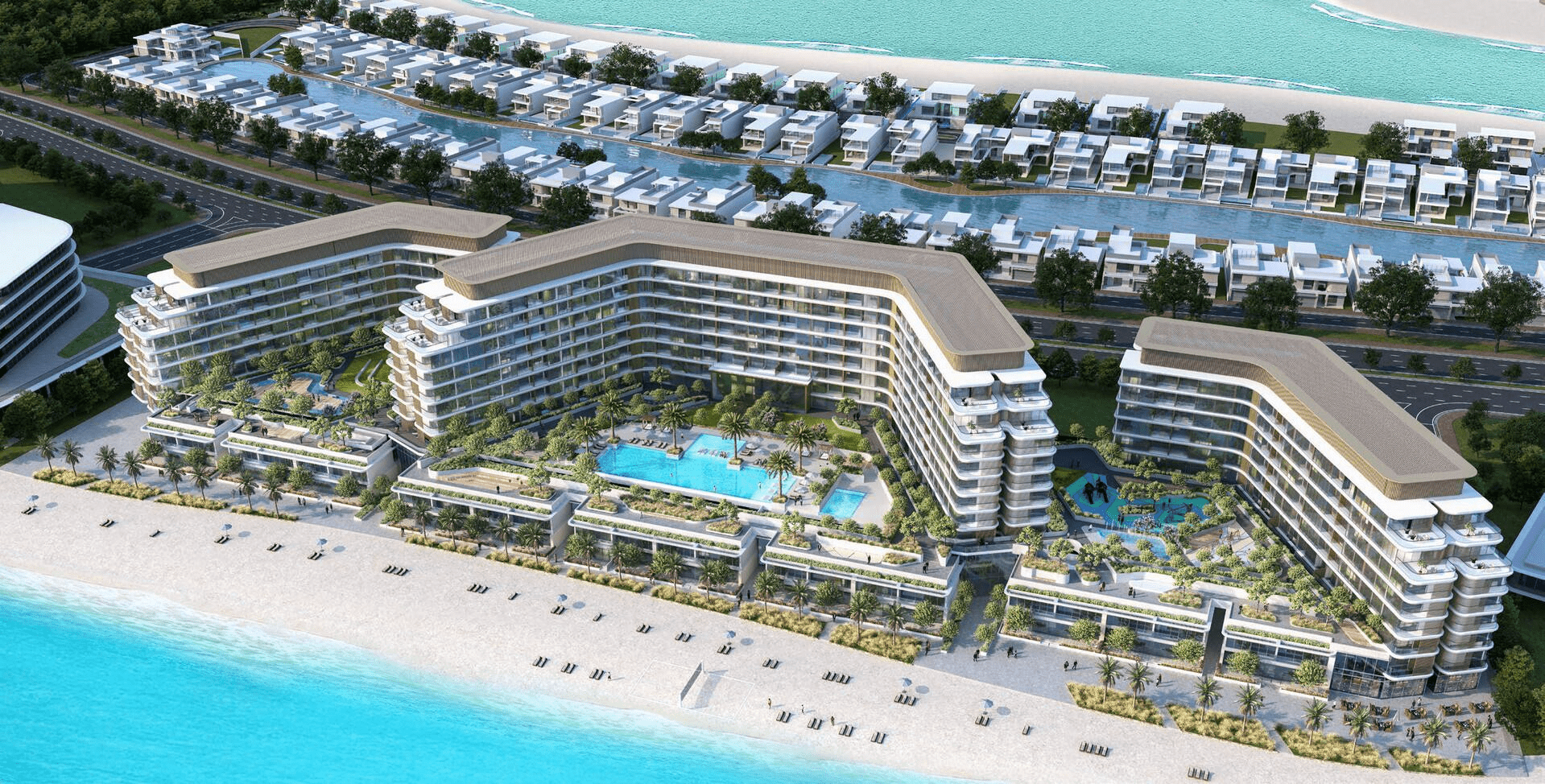

We shouldn't forget about villas and luxury real estate. For wealthy investors, this is a great opportunity not only to invest money, but also to enjoy a vacation in excellent conditions. In Sihanoukville, for example, luxury villas with sea views are being built and are in great demand among tourists and locals.

The average cost of a villa in Sihanoukville is from 200,000 to 500,000 dollarsDepending on the location and level of luxury. Investors can expect rental yields from such properties in the amount of 10-12% per yearespecially during the high tourist season.

Each of these types of real estate has its own advantages and risks. It is important to thoroughly research the market and choose the segment that suits your investment objectives. In the next section, we will take a closer look at the best areas in Cambodia for investment and their characteristics.

Cambodia's best areas for investment

When it comes to real estate investment in Cambodia, the choice of neighborhood is of utmost importance. Some locations offer more opportunities for growth and profitability than others. Let's take a look at a few key locations that may be ideal for your investment.

Phnom Penh: the capital of opportunity

Phnom Penh - is the heart of Cambodia and the main center of economic activity. Most of the opportunities for investors are concentrated here. New residential complexes, office buildings and commercial spaces are being actively developed in the capital. The city's infrastructure is improving every year, making it even more attractive for business and life.

For example, in the Tepkos neighborhood, where new housing developments are located, apartment rental prices are rising by 5-7% per year. This is a great opportunity for investors looking to earn a steady rental income. In Phnom Penh, the average cost of an apartment is from 1,500 to 3,000 dollars per square meter. Phnom Penh is also the cultural center of the country, which attracts both local and international tourists.

Sihanoukville: a resort gem

Sihanoukville - is not only a resort, but also a rapidly developing urban center. The city is becoming increasingly popular with tourists, and this creates a huge potential for investment. The real estate market in Sihanoukville is actively growing due to the construction of new hotels, restaurants and entertainment venues.

Every year the number of tourists increases, and this directly affects the demand for rentals. Investors who buy real estate on the Cambodian coast can count on high rental yield. For example, renting a villa by the sea can generate income of 10-12% per yearThis makes Sihanoukville a real boon for investors. The average cost of a villa in the area ranges from 200,000 to 500,000 dollars.

Commercial real estate in large cities

Don't forget about commercial real estate in major cities like Battambang and Kep. These regions also offer interesting investment opportunities. In recent years, there has been a growing interest in office and retail space, making them attractive investments.

For example, new shopping centers and office buildings are opening in Battambang, the second largest city in the country, creating additional jobs and attracting businesses. Investors who decide to invest in commercial real estate in this region can expect stable income and rising prices. The average cost of office space in Battambang ranges from 1,000 to 2,500 dollars per square meter.

Yield and return on investment in Cambodian real estate investment

This table summarizes the key aspects of returns and payback on real estate investments in Cambodia, as well as useful recommendations for investors.

| Parameter | Description | Notes |

|---|---|---|

| Rental income from real estate | The average rental yield is as follows 6-10% depending on the type of property and its location. Apartments in Phnom Penh can generate income at the level of 8%and resort real estate in Sihanoukville - to 12%. | Investing in resort real estate can be especially lucrative during the high tourist season. |

| Seasonality of income | Yields can vary depending on the season. In Sihanoukville, the high season lasts from November through Aprilwhen the number of tourists is at its peak. | During low season, returns can drop significantly, so it's important to consider seasonal fluctuations when planning your financial expectations. |

| Return on investment | The payback period for real estate investments is from 7 to 12 years old depending on the type of facility and its location. | For example, if you invest in an apartment for 100,000 dollars. yielding 8%the payback will be about 10-12 years old. |

| Yield forecasts | The real estate market in Cambodia is expected to continue to grow, which could result in higher rental yields and higher prices for properties. | Follow economic and political news to adapt your investment strategies. |

| Recommendations for investors | - Research the market and choose properties in sought-after neighborhoods. - Take seasonality into account when planning your revenue. - Diversify your investments. | A prudent asset allocation will help reduce risk and improve overall portfolio returns. |

This table will help you better understand the aspects of returns and return on investment in real estate in Cambodia. Proper planning and market research is the key to a successful investment.

Legal aspects of buying real estate in Cambodia

When it comes to buying real estate in Cambodia, it is important to know that there are certain legal nuances that need to be considered. For foreign investors, the process may seem complicated, but with the right approach, everything becomes much easier.

Purchase of real estate by foreigners

Foreigners can purchase real estate in Cambodiabut with certain restrictions. According to the legislation, foreigners have the right to own apartments and residential complexes on a full ownership basis. However, land ownership has its own peculiarities. Foreigners may lease land for a period of up to 99 yearsThis is quite an attractive option for those planning to build commercial or residential projects.

It is important to understand that when buying real estate in Cambodia, you need to work with reliable lawyers and real estate agents. They will help you to understand all legal aspects and avoid possible problems in the future.

Taxes and fees

Taxes and fees should also be considered when buying property in Cambodia. For example:

- Property transfer tax amounts to 4% of the transaction value.

- Notary fees may vary, but typically range from 0.5% to 1% of the value of the property.

- Registration fees may also be within 0.1% - 0.5% of the cost.

It's important to build these costs into your budget in advance to avoid unpleasant surprises.

Transaction processing

The process of real estate transactions in Cambodia involves several key steps:

- Signing of the preliminary contract. At this stage, the parties agree on the terms of the transaction.

- Payment of deposit. Usually the deposit is from 1% to 10% of the value of the property.

- Document verification. It is necessary to carefully check all documents for legality and absence of encumbrances.

- The final transaction and transfer of ownership. This process can take anywhere from a few weeks to a few months, depending on the complexity of the transaction and the availability of the necessary documents.

It's important to rememberIn addition, you should be aware that each step requires careful attention and a thorough review of all documents. Local lawyers and agents who know the ins and outs of the process can help you. Improper actions at any of the steps can lead to serious financial losses.

Recommendations

- Work with trusted agents and lawyers. This will help you avoid fraud and legal problems.

- Study the market. Understanding pricing and market trends will help you make a more informed choice.

- Observe all legal formalities. This will protect you from possible legal repercussions in the future.

By following these tips, you can successfully buy real estate in Cambodia and avoid common mistakes.

Risks of investing in Cambodian real estate

Investing in real estate in Cambodia can be lucrative, but it also comes with certain risks. It is important to understand these risks and know how to minimize them. Below is a table structuring the main risks and how to avoid them.

| Risk category | Risk description | Methods of minimization |

|---|---|---|

| Legal and legal risks | Lack of transparency in legislation can lead to problems with property rights and possible disputes. | Check all documents thoroughly, work only with reliable agents and lawyers, and consult with local experts. |

| Risks related to infrastructure | Construction quality issues and builders not meeting deadlines can cause delays and additional costs. | Study the reputation of the developer, check the reviews of other clients and choose only proven companies for cooperation. |

| Political risks | Political instability can cause uncertainty in the real estate market. Changes in the political environment may have a negative impact on investments. | Follow the news, analyze the political situation and take into account possible changes in legislation. |

| Economic risks | Changes in economic conditions, such as inflation or a drop in housing demand, can affect investment returns. | Diversify your investments by investing in different property types and regions to reduce the impact of economic fluctuations. |

| Risks related to tenants | Problems with tenants, such as non-payment of rent or property damage, can lead to financial loss. | Screen tenants carefully, and use leases with clear terms and conditions to protect your interests. |

This table will help you better understand the risks associated with investing in real estate in Cambodia and provide guidance on how to minimize them. Proper planning and preparation are key to a successful investment.

Tips for investors

If you are considering investing in real estate in Cambodia, here are some practical guidelines to help you make the right choice.

How to choose a profitable object for investment

First of all, determine your goals and budget. Research the market and choose properties that meet your expectations in terms of returns and risks. Don't forget the location: the closer the property is to tourist destinations or business centers, the more likely it is to generate a steady income.

How to effectively manage real estate in Cambodia

Property management can be either self-managed or through a property management company. If you don't have the time or desire to handle day-to-day operations, consider working with professional property managers who can help you optimize profitability and resolve all current issues.

Forecasts and recommendations for future investors

Pay attention to developing neighborhoods and new projects. For example, neighborhoods that are currently under active construction may become profitable in the future. Also keep an eye on changes in legislation and the economic situation to stay on top of trends.

Conclusion

Cambodia presents a unique opportunity for real estate investment. With its stable economic growth, developing infrastructure and growing number of tourists, now is a great time to consider investing in this dynamic country. If you are ready for a challenge and want a steady income, Cambodia could be your ideal choice.

If you would like to learn more about real estate investment opportunities in Cambodia or for advice, don't hesitate to contact us. We are here to help you every step of the way on your investment journey. Contact us by phone or email and let's start your successful investment together!

Cambodia offers stable economic growth, affordable real estate prices, a growing rental market and favorable conditions for foreign investors. This makes the country an attractive investment destination.

The most popular are apartments and residential complexes, commercial real estate (offices and retail space), resort real estate, and land plots for construction.

Foreigners can own apartments and residential complexes on a full ownership basis, but land ownership is only possible through a lease for up to 99 years. It is recommended to work with local lawyers to formalize transactions.

The average rental yield on a property in Cambodia ranges from 6% to 10%, depending on the type of property and its location. For example, resort properties can provide yields of up to 12%.

The main risks include legal and legal problems, deficiencies in infrastructure and construction, and political instability. It is important to carefully check properties and documents before buying.

When buying real estate, foreigners must pay property transfer tax, which is 4% of the transaction value. There are also notary fees and registration fees.

Research the market, consider location, infrastructure and accessibility. Phnom Penh and Sihanoukville are the most promising areas, but emerging cities such as Battambang and Kep are also worth considering.

The process includes signing a preliminary contract, paying a deposit, checking documents and finalizing the deal. It is recommended to work with lawyers to avoid possible problems.

You can manage the property yourself or contact a property management company. Professional property managers will help you optimize profitability and solve current issues.

Forecasts for the coming years remain positive, with expected growth in house prices and increased rental demand. Tourism continues to develop, which supports the real estate market.

What are the main benefits of investing in real estate in Cambodia?

Cambodia offers stable economic growth, affordable real estate prices, a growing rental market and favorable conditions for foreign investors. This makes the country an attractive investment destination.

What are the most popular types of real estate for investment in Cambodia?

The most popular are apartments and residential complexes, commercial real estate (offices and retail space), resort real estate, and land plots for construction.

How can foreigners purchase real estate in Cambodia?

Foreigners can own apartments and residential complexes on a full ownership basis, but land ownership is only possible through a lease for up to 99 years. It is recommended to work with local lawyers to formalize transactions.

What is the average return on rental property in Cambodia?

The average rental yield on a property in Cambodia ranges from 6% to 10%, depending on the type of property and its location. For example, resort properties can provide yields of up to 12%.

What are the risks involved in investing in real estate in Cambodia?

The main risks include legal and legal problems, deficiencies in infrastructure and construction, and political instability. It is important to carefully check properties and documents before buying.

What are the taxes and fees when buying real estate in Cambodia?

When buying real estate, foreigners must pay property transfer tax, which is 4% of the transaction value. There are also notary fees and registration fees.

How to choose the best neighborhood for real estate investment?

Research the market, consider location, infrastructure and accessibility. Phnom Penh and Sihanoukville are the most promising areas, but emerging cities such as Battambang and Kep are also worth considering.

What is the transaction procedure when buying real estate in Cambodia?

The process includes signing a preliminary contract, paying a deposit, checking documents and finalizing the deal. It is recommended to work with lawyers to avoid possible problems.

How to manage real estate in Cambodia?

You can manage the property yourself or contact a property management company. Professional property managers will help you optimize profitability and solve current issues.

What are your predictions for the real estate market in Cambodia in the coming years?

Forecasts for the coming years remain positive, with expected growth in house prices and increased rental demand. Tourism continues to develop, which supports the real estate market.