Buying real estate in Turkey for a foreigner

Buying real estate in Turkey for foreigners is becoming increasingly popular. This is due not only to attractive prices, but also to the possibility of obtaining a residence permit and even citizenship. Many people dream of their own corner on the shores of the Mediterranean Sea, and Turkey offers just such a solution. In this article we will consider in detail why it is worth paying attention to the Turkish real estate market, what advantages it provides to foreign buyers and how to choose the right object.

Turkey Real Estate Market Brief: Why Turkey is Popular with Foreign Buyers

Turkey attracts foreign real estate buyers like a magnet. Every year more and more people from different parts of the world decide to invest in Turkish real estate. Why? First of all, it's amazing climatic conditions. Mild winters and warm summers make the country an ideal place for life and recreation. Secondly, affordable prices for apartments and villas combined with high quality of life create attractive conditions for investment. For example, in Istanbul you can find cozy apartments overlooking the Bosphorus at prices that may seem fantastic in Europe.

Advantages of buying real estate in Turkey for foreigners

Investment prospects. Turkish real estate market is showing a steady growth. In recent years, housing prices have been increasing, which makes real estate investments profitable. For example, in Antalya, the average cost of an apartment has increased by 15% over the year. This is great news for those who consider buying as a way of investing. In addition, renting real estate on the coast brings a good income, especially during the tourist season.

Access to residence permit and citizenship. One of the most attractive aspects of buying real estate in Turkey is the possibility of obtaining a residence permit (residence permit) or even citizenship. If you purchase a property worth $400,000 or more, you can apply for citizenship. This opens up many opportunities for you, including the right to work and move freely around the country. I myself recently spoke to a woman who bought an apartment in Bodrum and was granted a residence permit after just a few months. She was delighted with how easy and quick it was!

Tax benefits. Turkey offers foreign owners a number of tax advantages. For example, you may not pay capital gains tax if you hold the property for more than five years. In addition, property taxes in Turkey are significantly lower than in most European countries. This is another argument in favor of considering buying property in this country.

How to choose the right real estate in Turkey

Determining the purpose of the purchase. Before you start looking for a property, it is important to understand what you are buying it for. It may be for personal residence, renting or investment. For example, if you plan to use the apartment only for recreation, you should pay attention to areas with good infrastructure and proximity to the beach. And if your goal is to generate rental income, it is better to choose properties in tourist areas.

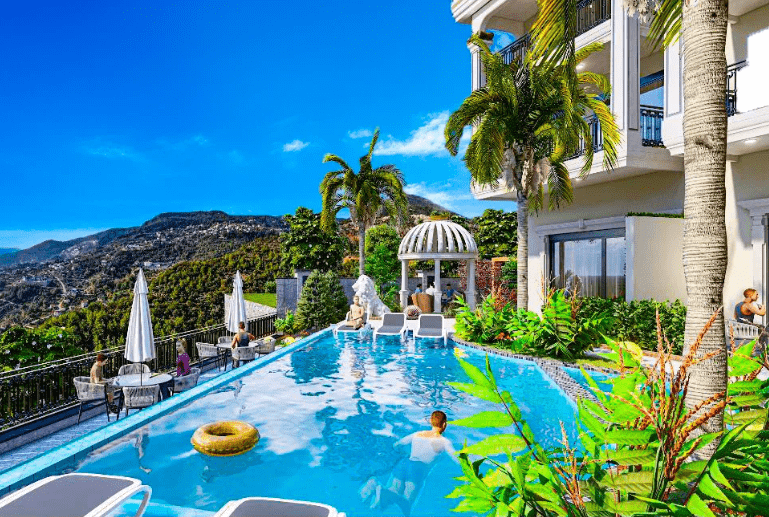

Region selection. Turkey offers many attractive regions to buy real estate. Istanbul is a dynamic metropolis with a rich history and culture. Antalya is famous for its beaches and tourist attractions. Alanya and Bodrum are ideal places for those looking for tranquility and beautiful nature. Each region has its own peculiarities, so it is worth researching carefully what exactly you want from your new home.

Types of properties. You can find different types of real estate in Turkey, from modern apartments to luxury villas and apartment complexes. For example, if you are looking for something more affordable, apartments in new buildings in Alanya can be a great option. And if luxury is your goal, villas in Bodrum with private pools and sea views are just what you need.

Cost and budget

When it comes to buying real estate in Turkey, it is important to consider your budget. Prices vary depending on the region and the type of property. For example, in Istanbul you can find apartments for as low as $100,000, but in more upscale neighborhoods such as Besiktas or Nishantasi, the cost can reach millions. At the same time, in Antalya or Alanya you can buy cozy housing for 50,000-80,000 dollars.

Don't forget to factor in additional costs such as purchase taxes, notary and real estate agency services. For example, purchase tax on real estate is 4% of the value, and the services of a lawyer can cost 1-3% of the transaction amount. Therefore, make sure you have a clear idea of all possible costs before making a decision.

Legal aspects of buying real estate by a foreigner

Buying real estate in Turkey is an exciting process that can be the beginning of a new life in the sunny country. However, before taking this step, it is important to understand the legal aspects associated with the purchase of real estate by foreigners. In this article we will look at the main legal restrictions, the purchase process, the necessary documents, the role of a lawyer and the specifics of transferring ownership.

| Aspect | Description |

|---|---|

| Legal restrictions | There are restrictions on the purchase of real estate for foreigners in Turkey. You cannot buy land in agricultural areas or in military areas. Be sure to research local laws and regulations before you start your search to avoid trouble. |

| The real estate purchase process | The process may seem complicated, but with the right approach it goes smoothly. It usually involves: finding a property, signing a preliminary contract, paying a deposit, finalizing the deal and obtaining a certificate of ownership (TAPU). Using the services of a reliable agency and lawyer simplifies the process. |

| Documents required for the transaction | For a successful purchase, you will need a passport, a Turkish taxpayer identification number and documents proving the source of income. All documents must be translated into Turkish and notarized. This will help to avoid problems in the future. |

| Role of the lawyer | Involving a lawyer is a necessity, not a formality. A good lawyer will help to understand all aspects and protect your interests by checking that there are no encumbrances on the property and the seller's right to sell. Do not skimp on this stage - it is your safety and peace of mind. |

| Peculiarities of transfer of ownership (TAPU) | Obtaining a certificate of ownership (TAPU) is the final stage of the purchase. This document confirms your rights to the property and is necessary for further registration of residence permit or citizenship. It is important that all data is correctly indicated in the TAPU to avoid problems in the future. |

Thus, buying real estate in Turkey is not only a profitable investment, but also an opportunity to start a new life in a country with a rich culture and history. Understanding the legal aspects such as legal restrictions, the purchase process, the required documents and the role of a lawyer will help you avoid common mistakes and make the transaction as safe as possible. If you are ready to take a step towards your dream of owning your own home in Turkey, follow the recommendations and may your journey be a successful one!

Financial aspects

When it comes to buying real estate in Turkey, understanding the financial aspects is key to a successful transaction. Many foreigners underestimate hidden costs and taxes, which can lead to unpleasant surprises. Let's take a closer look at what costs you can expect to incur.

Cost formation and hidden costs

The first thing to consider is the cost of the property itself. However, beyond that, there are other costs that can significantly affect your budget. For example, you should consider:

- Purchase tax: As mentioned above, property purchase tax is 4% of the value of the property. This is a mandatory payment that you must take into account.

- Notary services: Usually it is 1-2% of the value of the transaction. The notary certifies the signing of documents and ensures the legality of the transaction.

- Agency commission: If you work with a real estate agent, they may charge a commission of 2-5% of the purchase price.

- Registration and registration: These costs can vary, but average around $500 to $1,000.

It's important to plan your budget in advance and factor in all of these additional costs to avoid financial hardship.

Real estate taxes in Turkey

After buying a property, you will also need to consider property taxes. In Turkey, there are several types of taxes that can affect property owners:

- Property tax: This tax is 0.1% of the cadastral value for residential properties and 0.2% for commercial properties. It is paid annually.

- Tax on rental income: If you plan to rent out your property, you will need to pay tax on rental income. The tax rate varies from 15% to 35% depending on the amount of income.

These taxes may seem insignificant, but they can have a significant impact on your bottom line if you plan to rent out the property.

Mortgage for foreigners

If you do not want to or cannot pay the full amount at once, mortgages for foreigners are available in Turkey. Many banks offer such services and the terms may vary. You will usually need to make a down payment, which ranges from 30% to 50% of the value of the property. Interest rates can range from 6% to 10% depending on the bank and terms.

You will need the following documents to qualify for a mortgage:

- Passport

- Proof of income

- Bank statement

- Credit history (if any)

Be sure to consult several banks to find the most favorable terms. I know a man who took out a mortgage with a Turkish bank and was very satisfied. He was able to buy his dream - an apartment by the sea, and now he is enjoying life in Turkey.

Calculation of tax on rental income

If you decide to rent out your property, you need to know how income tax is calculated. You will have to pay tax on all the income you receive from the rental, after deducting certain expenses such as:

- Public utilities

- Service costs

- Property taxes

It is important to keep records of all income and expenses in order to calculate tax correctly. This will help you avoid problems with the tax authorities and save money.

Thus, understanding the financial aspects of buying real estate in Turkey is an important step towards a successful transaction. In the next part we will look at how to obtain residence permit and citizenship through the purchase of real estate, so that you can take advantage of all the benefits that this country offers.

Registration of residence permit and citizenship through the purchase of real estate

One of the most attractive aspects of buying real estate in Turkey for foreigners is the possibility of obtaining a residence permit (residence permit) and even citizenship. Let's understand how this works and what steps you need to take to achieve this goal.

Residence permit when buying real estate

To get a residence permit when buying real estate in Turkey, you need to fulfill several conditions. First, the minimum value of the property must be at least 400,000 US dollars. It can be either an apartment or a villa. After the purchase, you can apply for a residence permit by submitting the following documents:

- Copy of passport.

- Certificate of ownership (TAPU).

- Photos (usually 4).

- Health insurance.

- Proof of financial solvency (bank statements).

The process of obtaining a residence permit usually takes from 1 to 3 months, depending on the workload of the migration services. I know several people who went through this process and were satisfied. They noted that despite the bureaucratic nuances, everything went quite smoothly, especially if you have the help of a lawyer.

Citizenship through real estate investments

If you want to obtain Turkish citizenship, you will need to fulfill the same conditions as for residence permit, but with some additional requirements added. As mentioned above, the minimum amount for citizenship is 400,000 dollars. However, it is important to remember that you must hold this property for at least three years.

You will need the following documents to apply for citizenship:

- Copy of passport.

- Certificate of ownership (TAPU).

- Financial documents confirming the source of income.

- Certificate of no criminal record.

- Health insurance.

- Photos.

The process of obtaining citizenship can take from 6 to 12 months. Many who have gone through this path say that it is a great opportunity to create a new life in Turkey, as well as to gain access to quality education, health services and other benefits that citizenship provides.

Advantages and limitations of residence permit and citizenship through real estate

Obtaining residence permit or citizenship through real estate investment opens up many opportunities. For example, you will be able to move freely around Turkey, work and do business. In addition, Turkish citizenship allows you to travel visa-free to more than 110 countries, including Schengen countries.

However, it is also worth remembering some restrictions. For example, Turkish citizens are obliged to serve in the army if they are men. Also, although a residence permit gives you the right to reside, it is not permanent and you will need to renew it every 2 years.

Thus, buying real estate in Turkey is not only an investment in your own home, but also an opportunity to obtain a residence permit or citizenship, which opens up new horizons for you. In the next part of this article we will look at the potential risks and tips for foreign buyers, so that you can avoid common mistakes and make your deal as safe as possible.

Potential risks and advice for foreigners

Buying real estate in Turkey can be an exciting and rewarding process, but as in any other country, there are pitfalls. Let's take a look at the main risks foreign buyers may face and how to avoid them.

Caution when selecting a site

The first thing to look at is the choice of property. Many foreigners, especially those who buy real estate on the secondary market, can run into problems if they do not do a proper inspection. For example, I heard a story about a couple who bought an apartment in Antalya without inspecting it in person. When they arrived, it turned out that the apartment had serious plumbing and electrical problems that the seller had chosen not to mention. This resulted in significant additional repair costs.

Therefore, it is always advisable to inspect the property in person or at least with a trusted agent. Be sure to check all details and ask questions about the condition of the property. Do not hesitate to ask for additional photos or videos if you cannot visit the property.

Fraud and additional documents

Unfortunately, real estate fraud is a reality that many buyers face. Some unscrupulous sellers may try to sell properties that don't belong to them or hide legal problems. To avoid this, be sure to check title documents and check for encumbrances.

You should also be careful about additional documents. For example, if the seller offers you a "super-profitable" deal, don't be lazy to check all the details. I know people who have fallen for the tricks of fraudsters, but after consulting a lawyer, they were able to get their money back and avoid losses.

Importance of site inspection

As mentioned above, inspecting the property is a key step. But in addition to a visual inspection, it's worth paying attention to the surrounding infrastructure. Find out what stores, schools and medical facilities are nearby. This will help you not only assess the convenience of living, but also understand how easy it will be to rent out the apartment, if you plan to do so.

Recommendations for choosing an agency

Choosing a reliable real estate agency is another important step. Be sure to check the agency's reputation, read reviews and ask your friends for recommendations. A good agency should have experience working with foreign clients and know all the nuances of the local market.

It is also important that the agent is willing to give you complete information about the buying process and answer all of your questions. Don't hesitate to ask questions about commission and terms and conditions. I know people who have chosen the wrong agency and encountered problems that could have been avoided with the right choice.

Maintenance and real estate expenses

Buying a property in Turkey is an important step that opens up many opportunities for you. However, in addition to the initial purchase costs, it is important to consider the regular costs of maintaining your property. These costs can vary and knowing them will help you avoid unpleasant surprises in the future. In this article, we will look at the main cost items associated with maintaining a property in Turkey.

| Aspect | Description | Cost (in USD) |

|---|---|---|

| Utilities and taxes | The average cost for electricity, water, and gas is about $100 to $150 per month for an apartment. These amounts may vary depending on the size and location of the dwelling. | 100-150 dollars a month |

| Property tax | Property tax is 0.1% of the cadastral value for residential properties. Make sure you include these costs in your budget. | Depends on cadastral value |

| Cost of annual maintenance | If you bought a condo or apartment complex, maintenance costs can range from $30 to $100 per month, depending on the level of service and amenities. | 30-100 dollars a month. |

| Repair and maintenance expenses | It is advisable to set aside a small budget for unexpected expenses, as problems may arise over time that require repairs. | Recommended 5-10% of the cost of housing |

Thus, buying real estate in Turkey is not only a profitable investment, but also an opportunity to enjoy life in one of the most beautiful countries in the world. Taking into account the regular costs of utilities, taxes, maintenance and repairs will help you keep your property in good condition and avoid unpleasant surprises in the future. Be prepared for these expenses and your investment will be a source of joy and comfort for years to come. In the next section, we will summarize and give you tips for a successful transaction so that you can step into the world of Turkish real estate with confidence.

Conclusion

Buying real estate in Turkey for foreigners opens up many opportunities for you, from living in the sunny country to investment prospects. However, as with anything else, it is important to be knowledgeable and prepared. We have looked at the key aspects that will help you make the right choice and avoid common mistakes.

If you have any questions or would like to learn more, please contact us by phone or email. We look forward to helping you on this exciting journey!

Yes, foreign nationals can buy real estate in Turkey. Only some countries are exceptions, but most nationalities can purchase residential or commercial real estate without restrictions.

Foreigners can buy residential and commercial real estate, as well as land plots (with reservations). The most popular are apartments, villas and building plots.

No, a residence permit is not required to purchase real estate in Turkey. However, property owners can apply for a residence permit after the purchase.

When buying a property, a transfer tax is paid, which is 4% of the value of the property and is divided between the seller and the buyer.

To obtain citizenship through investment in Turkey, you must purchase real estate worth at least $400,000 and keep it in your possession for three years.

In Turkey, the purchase of real estate can be notarized, but it is not a mandatory requirement. Usually transactions go through the cadastral office (Tapu), which regulates and records the transfer of ownership.

Yes, foreigners can get a mortgage loan from Turkish banks to buy real estate. However, the terms of the loan may differ depending on the bank and the nationality of the buyer.

Additional costs include property transfer tax, legal and administrative fees, interpreter services and, if applicable, real estate agency fees.

Foreign nationals may purchase no more than 30 hectares within one province of Turkey and no more than 10% of the area of the municipality in which the property is purchased.

Can foreigners purchase real estate in Turkey?

Yes, foreign nationals can buy real estate in Turkey. Only some countries are exceptions, but most nationalities can purchase residential or commercial real estate without restrictions.

What types of real estate are available for purchase by foreigners?

Foreigners can buy residential and commercial real estate, as well as land plots (with reservations). The most popular are apartments, villas and building plots.

Do I need a residence permit to buy real estate in Turkey?

No, a residence permit is not required to purchase real estate in Turkey. However, property owners can apply for a residence permit after the purchase.

What tax is payable when buying real estate in Turkey?

When buying a property, a transfer tax is paid, which is 4% of the value of the property and is divided between the seller and the buyer.

What is the minimum investment amount to obtain Turkish citizenship?

To obtain citizenship through investment in Turkey, you must purchase real estate worth at least $400,000 and keep it in your possession for three years.

Do I need a notary when buying real estate?

In Turkey, the purchase of real estate can be notarized, but it is not a mandatory requirement. Usually transactions go through the cadastral office (Tapu), which regulates and records the transfer of ownership.

Can a foreign citizen get a mortgage in Turkey?

Yes, foreigners can get a mortgage loan from Turkish banks to buy real estate. However, the terms of the loan may differ depending on the bank and the nationality of the buyer.

What are the additional costs associated with buying real estate in Turkey?

Additional costs include property transfer tax, legal and administrative fees, interpreter services and, if applicable, real estate agency fees.

Are there restrictions on the amount of real estate a foreigner can buy?

Foreign nationals may purchase no more than 30 hectares within one province of Turkey and no more than 10% of the area of the municipality in which the property is purchased.