How to open an account in Dubai in 2025

Dubai and the UAE have become prominent players on the international financial scene, attracting investors and entrepreneurs from all over the world with their progressive economic policies, stability and high standard of living. This in-depth guide will tell you everything you need to know about opening a bank account in Dubai and the UAE in 2025. We cover everything from an overview of the banking system to the process of opening an account, as well as expert advice and answers to frequently asked questions.

Overview of the banking system in Dubai and the UAE

The banking regulatory system in Dubai and the UAE is one of the most stable and reliable in the world. Banks in the UAE offer a wide range of services to meet the various needs of their customers. Below is a table that gives an overview of some of these services:

| Account type | For whom it is intended | Basic services |

|---|---|---|

| Corporate accounts | Local and international companies | Corporate finance management, bank guarantees, trade finance |

| Personal accounts | Residents and non-residents | Debit and credit cards, savings accounts, mortgage lending |

| Accounts for companies registered in free zones | Companies registered in free zones | Corporate finance management, trade finance |

| Accounts for offshore companies | Offshore companies | Corporate finance management, trade finance |

In addition, many banks offer online banking services that allow customers to manage their accounts from anywhere in the world, which is especially convenient for non-residents and international businessmen.

Why choose Dubai and the UAE for banking operations

Dubai and the UAE have become a global financial center, attracting major international banks and financial institutions. This provides access to an international banking network and facilitates international transactions. Whether it is money transfers, trade transactions or investment deals, Dubai and the UAE ensures efficient and timely execution.

In addition, the UAE offers unique opportunities for investment and business expansion. Free zones in Dubai and other emirates offer special conditions for business, such as tax exemption, full ownership by foreigners and freedom to import and export capital.

It is important to note that the UAE is actively developing fintech and digital technologies in the banking industry. This means that banking customers in the UAE have access to the latest innovations such as mobile banking, biometric identification, digital wallets and other advanced solutions.

Finally, the UAE has one of the highest degrees of political and economic stability in the Middle East region. This makes it an ideal place to hold assets and conduct banking operations, especially in times of global instability.

Advantages of the UAE banking system compared to other countries

| Comparative characteristics | UAE | Great Britain | Germany |

|---|---|---|---|

| Currency stability | The UAE dirham is pegged to the US dollar, which provides stability and protection from currency fluctuations. | The pound sterling is subject to currency fluctuations which may affect the value of investments. | The euro is also subject to currency fluctuations, but to a lesser extent than the pound. |

| Taxation | No income tax for corporations and no income tax for individuals. | Corporations are subject to income tax and individuals pay income tax. | Both corporations and individuals are taxed. |

| Banking services | Fast and efficient banking services, including online banking and a mobile banking app. | Banking services also include online banking and mobile apps, but the processes may be less fast. | Banking services include online banking, but mobile apps may not be as prevalent. |

| Privacy protection | High level of confidentiality protection, banks cannot disclose information without the client's consent or as required by law. | Banks are bound by strict data protection laws, but may be required to share information with tax authorities. | Data protection laws are also strict, but banks may be required to share information with tax authorities. |

Categories of bank accounts

Different types of bank accounts are available in Dubai and the UAE to meet the different needs and requirements of customers. This includes personal bank accounts for residents and non-residents, corporate accounts for local and international companies, and specialized accounts for companies registered in free zones and offshore companies.

Personal bank accounts

Personal bank accounts in Dubai and the UAE offer many benefits, including competitive interest rates, access to a wide range of banking services such as debit and credit cards, online banking, and the ability to receive your salary directly into the account. Banks also offer specialized accounts for students, retirees, and women, tailored to their unique needs.

Corporate accounts

Corporate accounts in Dubai and UAE are designed to meet the needs of businesses. They offer companies access to a wide range of services including corporate cards, cash management services, trade finance and more. Corporate accounts also facilitate international transactions and currency exchange, making them an ideal choice for companies doing business internationally.

Accounts for companies in free zones and offshore companies

Companies registered in free zones and offshore companies in the UAE can also open bank accounts. These accounts offer a number of benefits including ease of doing business, tax benefits and confidentiality. They also give companies access to international markets and facilitate international transactions.

Choosing the right type of bank account in Dubai and the UAE depends on your individual needs and circumstances. For example, if you plan to live and work in the UAE, a personal bank account may be the most suitable option. If you own a company and plan to run a UAE businessA corporate account will be the most appropriate. It is important to do thorough research and consult with a bank advisor to make the right decision.

Requirements for opening an account

To open a bank account in Dubai or the UAE, you will need to provide a number of documents for verification. These include:

- Valid passport: This is the main document required to open a bank account. Some banks may also ask for a visa, especially if you are a foreigner.

- Proof of address: This can be a utility bill, a rental agreement, or any other document that proves your UAE residential address.

- Documents proving employment or business: This can be an employment contract, business license, or any other document that proves your employment or business.

- Availability of minimum balance: Some banks in the UAE may require you to have a certain minimum balance in your account at all times.

- Income statement: In some cases, the bank may request an income statement to confirm your ability to manage the account.

- Confirmation of taxpayer identification number: If you are a tax resident of another country, you may be required to provide your taxpayer identification number.

- Certificate of good credit rating: Some banks may ask for a certificate of good credit rating from a previous bank.

- Application for account opening: You will need to fill out and sign an account application form provided by the bank.

- For corporate accounts: You may need to provide the company's constituent documents such as articles of association, certificate of incorporation, resolution appointing directors, etc.

- Verification of compliance with the bank's standards: Banks in the UAE strictly enforce anti-money laundering and counter-terrorist financing standards. Therefore, they may carry out checks to ensure compliance with these standards before opening an account.

UAE Bank Overview

There are many banks in the UAE, each offering unique services and offers.

- Emirates NBD: It is the largest bank in the UAE by total assets. Emirates NBD offers a wide range of products and services including private, corporate and investment banking as well as Islamic products and services. The bank also offers a mobile app for the convenience of customers to manage their accounts, transfer money and perform other transactions.

- Abu Dhabi Commercial Bank (ADCB): ADCB is one of the largest banks in the UAE offering a wide range of products and services including private, corporate and Islamic banking. ADCB also offers online and mobile banking services for the convenience of its customers.

- Dubai Islamic Bank (DIB): DIB is the first Islamic bank in the world to offer a full range of Islamic banking services. DIB is known for its innovative products and services that are in line with Islamic principles.

- Mashreq Bank: Mashreq Bank is one of the oldest banks in the UAE offering a wide range of products and services including private, corporate and Islamic banking. Mashreq also offers online and mobile banking services for the convenience of its customers.

It is important to note that there are many factors to consider when choosing a bank in the UAE, including the bank's reputation, products and services offered, customer service levels, and rates and fees. It is also advisable to compare different banks and their offers before making a decision.

Steps to opening a bank account

- Choice of bank and type of account: There are many banks in the UAE that offer different types of accounts including current accounts, savings accounts, deposit accounts and even Islamic accounts. Your choice will depend on your personal and financial needs.

- Preparation of documents: To open a bank account in UAE you will need the following documents: passport, visa, letter from your employer (if you are employed), proof of address and maybe some other documents depending on the bank.

- Submitting an application: Once you have collected all the necessary documents, you can apply for an account opening. You can do this in person at the bank or online if the bank offers this service.

- Document verification: The bank will check your documents and information. At that time they may request additional documents or information.

- Account opening: After successful verification, your account will be opened. The bank will provide you with your account information, including account number and login information for online banking.

- Account utilization: Now that you have an account, you can start using it for your financial needs. This can include deposits, cash withdrawals, money transfers, bill payments and more.

- Account maintenance: Remember that opening an account is just the beginning. You will also need to maintain your account, keep track of your balance, pay any fees, etc.

- Online banking: Most banks in UAE offer online banking services that allow you to manage your account, make transfers, pay bills, etc. from anywhere and anytime.

- Safety: It is important to keep your bank account secure. Never share your personal or banking information with anyone. Be alert to any suspicious activity or messages and always contact the bank if you have any doubts.

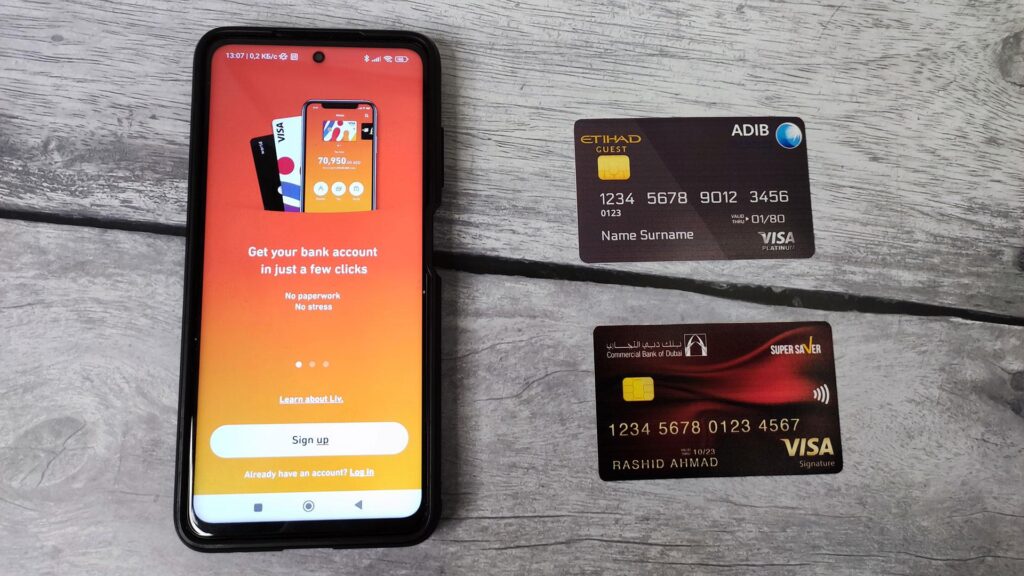

Features of online banking in the UAE

All banks in the UAE offer online banking services that allow customers to manage their accounts, conduct transactions and keep track of their finances from anywhere in the world. Online banking in the UAE offers convenience, efficiency and a high level of security, making it an ideal choice for international businessmen and investors.

- Multilingualism: Most banking websites and mobile apps in the UAE support multiple languages, including Arabic and English, to ensure ease of use for international customers.

- Fast and simple transactions: Online banking allows you to make payments and fund transfers, order checkbooks, pay bills and more, all at any time of the day or night.

- Mobile apps: Most banks in the UAE have mobile apps that offer all online banking features and allow customers to manage their accounts on the go.

- Safety: Banks in the UAE use advanced security technologies to ensure the safety of their customers' accounts and transactions. This includes two-factor authentication, data encryption and regular security updates.

- Foreign exchange transactions: Online banking in the UAE allows transactions in a variety of currencies, which is especially convenient for those who travel frequently or conduct international business.

- Customer Support: Most of the banks in UAE offer 24/7 customer support to resolve any online banking related queries or issues.

- Planning and tracking: Some banks offer budget planning and expense tracking tools to help customers monitor and manage their finances.

- Electronic notifications: Customers can set up email alerts for various transactions on their accounts, which helps them stay informed about all financial transactions.

Investment opportunities for account holders

UAE bank account holders have access to a wide range of investment opportunities.

- Deposits: This is one of the easiest and safest ways to invest. Account holders can open a deposit account and earn interest on their invested funds. UAE offers different types of deposits including savings deposits, time deposits and high yield deposits.

- Stocks: Investing in shares of companies is another popular option for account holders. UAE banks offer brokers to buy and sell shares on local and international stock exchanges.

- Bonds: Bonds are securities that represent borrowed funds provided by a company or government. Account holders can buy bonds and receive regular interest payments.

- Mutual funds: These are investment funds that raise money from multiple investors to invest in a portfolio of securities. Account holders can invest in these funds and earn income in the form of dividends or capital gains.

- Realty: UAE banks also offer mortgage products that allow account holders to invest in real estate. Investing in real estate can provide a stable rental incomeas well as the potential increase in property value.

- Gold and other precious metals: Account holders can invest in gold and other precious metals, which are often considered a safe haven during times of economic instability.

- Investment accounts: Some banks in the UAE offer special investment accounts that provide access to a wide range of investment products and services.

- Pension plans: Account holders can also invest in retirement plans that offer tax benefits and help save for retirement.

- Investing in startups: UAE is one of the leading regions for innovation and startups. Account holders can invest in these startups and earn high returns if the startup becomes successful.

- Investing in cryptocurrency: Despite volatility, cryptocurrencies such as bitcoin offer opportunities for high returns. Some banks in the UAE are starting to offer cryptocurrency investment services.

It is important to remember that all investments carry risk and it is important to do thorough research and/or consult with a financial advisor before making an investment decision.

Success stories

Many entrepreneurs and investors have already successfully opened bank accounts in the UAE and use them to support their business and investment strategies.

- An IT entrepreneur has successfully opened a business account in the UAE. This enabled him to improve his relationship with international clients and partners, as he can now accept payments in different currencies without any hassle. Moreover, thanks to the high-quality banking services, he was able to significantly improve his financial management system.

- A real estate investor opened an account in the UAE to manage his investments. Thanks to the UAE banking system, he had access to a wide range of investment products and services that helped him expand his portfolio and increase his returns.

- The owner of an e-commerce startup opened a business account in the UAE to simplify the process of accepting payments from his customers around the world. He also used the account to invest in his business and expand its operations.

- An international trader opened an account in the UAE to facilitate his trading activities. Thanks to UAE banking services, he was able to process international payments quickly and efficiently, giving him a competitive advantage in the market.

Their success stories serve as inspiration and proof that the UAE banking system does offer many benefits and opportunities.

Opening a bank account in Dubai or UAE is an important step for any businessman or investor looking to expand internationally. Thanks to a stable economy, progressive banking system and attractive UAE tax policy have become the perfect place to open a bank account.

Any resident or non-resident can open a bank account in Dubai, provided the necessary documents are provided.

Opening an account requires a valid passport, visa (for foreign nationals), proof of UAE residence address, proof of employment or business, and possibly an income certificate.

Yes, foreigners can open an account with some banks as non-residents, but the services available and document requirements may differ.

Personal accounts, corporate accounts, accounts for companies registered in free zones and offshore accounts are available in Dubai.

Benefits include access to an international banking network, efficient and fast banking services, tax benefits, high levels of privacy and a stable currency.

In most cases, banks require personal presence to open an account, but some banks may offer alternative procedures for non-residents.

Banks in Dubai offer extensive facilities for international transfers, but certain restrictions and reporting requirements under international anti-money laundering standards may apply.

The time frame can vary from a few days to a few weeks depending on the bank and the completeness of the documentation provided.

Emirates NBD, Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB) and Mashreq Bank are often recommended due to their international orientation and wide range of services.

Fees and commissions depend on the selected bank and type of account. It is important to clarify these conditions in advance when choosing a bank to open an account.

Who can open a bank account in Dubai and UAE?

Any resident or non-resident can open a bank account in Dubai, provided the necessary documents are provided.

What documents are required to open an account in Dubai?

Opening an account requires a valid passport, visa (for foreign nationals), proof of UAE residence address, proof of employment or business, and possibly an income certificate.

Can foreigners open an account in Dubai without living in the UAE?

Yes, foreigners can open an account with some banks as non-residents, but the services available and document requirements may differ.

What types of bank accounts are available in Dubai?

Personal accounts, corporate accounts, accounts for companies registered in free zones and offshore accounts are available in Dubai.

What are the advantages of opening an account in Dubai for a foreign investor?

Benefits include access to an international banking network, efficient and fast banking services, tax benefits, high levels of privacy and a stable currency.

Do I need to be in Dubai in person to open an account?

In most cases, banks require personal presence to open an account, but some banks may offer alternative procedures for non-residents.

Are there any restrictions on international transfers for Dubai accounts?

Banks in Dubai offer extensive facilities for international transfers, but certain restrictions and reporting requirements under international anti-money laundering standards may apply.

What is the average timeframe for opening an account in Dubai?

The time frame can vary from a few days to a few weeks depending on the bank and the completeness of the documentation provided.

Which banks in Dubai are recommended for foreign investors?

Emirates NBD, Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB) and Mashreq Bank are often recommended due to their international orientation and wide range of services.

What are the fees and charges for maintaining an account in Dubai?

Fees and commissions depend on the selected bank and type of account. It is important to clarify these conditions in advance when choosing a bank to open an account.